Team 8, an Israel-based cybersecurity incubator, is looking to raise up to $85m for its new venture capital fund.

Team8 Partners II is yet to raise any commitments from LPs according to filing with the US Securities and Exchange Commission. The firm is yet to report a first close or officially announce the fund.

Following their experience in the Israeli Defense Force’s intelligence unit 8200 and their work in the private sector, Nadav Zafrir, Israel Grimberg, and Liran Grinberg co-founded the business in 2015. Team8 launched following a $18m Series, with capital coming from Alcatel-Lucent, Cisco Investments, Marker LLC, Bessemer Venture Partners (BVP) and Innovation Endeavors.

In 2016, the part think tank and part startup incubator announced a $23m Series B round, with AT&T, Accenture, Nokia, Mitsui, and Temasek all participating.

Team8 markets itself as Israel’s leading cybersecurity think tank and company creation platform. Its mission is to develop disruptive companies ‘that challenge the biggest problems in cybersecurity and give organisations the advantage over cyber attackers’ according to its website.

After an entrepreneur or security expert signs on, the team gives acts as an incubator, providing them with the logistics of starting a new business.

The entrepreneurs that Team8 decides to work are provided with funding, technical guidance, go-to-business planning and the tools for a start-up to get off the ground.

Team8 is currently backing five companies: Illusive Networks, Claroty, Sygnia, Hysolate and Portshift. The businesses provide a range of services to the cybersecurity landscape including industrial IoT security, consulting and incident response, application security and endpoint isolation.

Cybersecurity investments decline

According to a recent cybersecurity report from RegTech Analyst, capital invested in the first quarter of this year declined by half compared to Q4 2017. Total investment in Q1 2018 reached just $725.8m, a fall of 47.7% from the previous quarter. However, compared to the same quarter in 2017, total funding increased by 27%. The drop in investment in Q1 2018 can be attributed to a lack of later-stage deals valued above $100m.

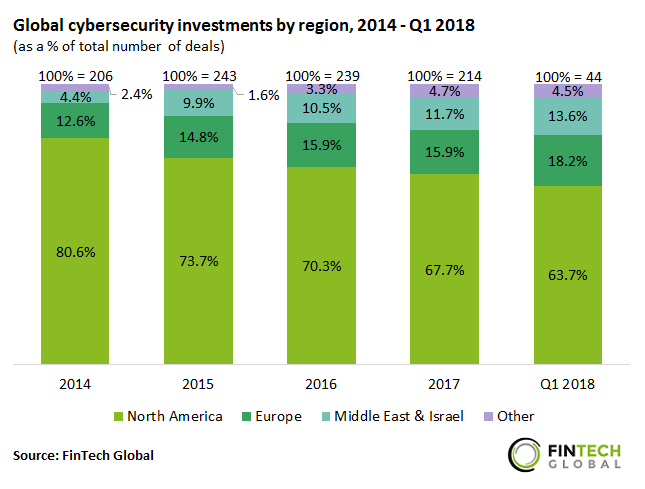

Between 2014 and 2017, North America’s share of deals dropped by 12.9 percentage points (pp) from 80.6% to 67.7%. This share further decreased in Q1 2018 reaching 63.7%. This was mainly offset by an increase in deal share in both Europe and the Middle East & Israel. Similarly, the Middle East & Israel’s share of deals jumped from 4.4% in 2014 to 11.7% in 2017. This value reached 13.6% in Q1 2018, more than triple the original value.

Copyright © 2018 RegTech Analyst