Many businesses don’t yet have a handle on their regulatory requirements and responsibilities associated with GDPR, according to ID-Pal CEO James O’Toole.

With ID-Pal providing a digital KYC solution that enables businesses to verify their client’s identity, the company is keeping close tabs on the EU General Data Protection Regulation (GDPR).

O’Toole told RegTech Analyst, “GDPR is of critical importance to our solutions, given the sensitive nature of customer information that is being dealt with. Many businesses are still struggling to get a proper handle on their requirements and responsibilities arising from this far reaching regulation. This complexity creates a massive opportunity for RegTech firms such as ourselves to simplify the compliance process so that businesses can focus more attention on their core capabilities.”

GDPR, which will come into force on the 25th May 2018, will impact every business that processes or collects data from EU citizens. Failure to meet the regulatory requirements could result in significant penalties of up to €20m or 4% of global annual turnover

“Helping stakeholders establish and maintain trust with one another is a key plank of our mission. Businesses need to trust that their customers are whom they say they are… Customers need to trust that businesses will keep their personal information secure and private… which is why we have added a DPO and CISO to our team and formed a strategic partnership with cybersecurity and data privacy experts ISAS to ensure best practice is baked into every aspect of our end-to-end solution.”

Another regulation the KYC provider is getting tabs on is The Second Payment Services Directive (PSD2) according to O’Toole. PSD2 requires banks to open their payments infrastructure and customer data assets to third parties that can then develop payments and information services to customers. However, while the regulation will have huge implications on the financial services space, it is still unclear what the exact impact will be once the dust settles according to O’Toole.

“PSD2 is a very interesting one. There are many diverse opinions as to how the changing dynamics of open banking will impact industry players,” he said. “But in terms of ID-Pal, the regulation requires Payment Service Providers to provide strong customer authentication for senders who initiate electronic payments…which is perhaps why we’ve been getting the traction we have been from the payments industry more recently.”

FinTech Collaboration

With the industry moving faster than regulation can keep pace with, regulators are making greater efforts to ensure they understand the technologies which are now available in the marketplace. Regulators are also looking to provide more clarity around cloud and blockchain based offerings, as well as provide access to innovation support structures such as sandboxes and safe harbours according to O’Toole.

“At ID-Pal, we are big proponents of increased communication amongst key players within the regulated market. We recently presented to the OCC (the Office of the Comptroller of the Currency), one of the regulators in the US, showcasing our solution. We’ve had similar conversations with regulators on this side of the pond as well. These engagements help to open up dialogue between FinTech players bringing innovative solutions to the market, and the regulator who needs to get a better understanding of how these solutions work so they can better support with appropriate regulation.”

Nearly half of all RegTech companies in the market address AML or KYC regulation according to the Global RegTech Review.

The solutions offered by RegTech companies directly related to regulatory issues or challenges faced by financial institutions. Given the increasingly complex requirements placed by regulatory authorities on AML and KYC procedures, along with the heavy fines imposed for inadequate compliance, it is no surprise that a majority of RegTech solutions address these particular areas of legislation. Over 100 companies around the world provide offerings that makes compliance with AML and KYC regulation more effective or more efficient according to the review.

An analysis of the capital invested in RegTech companies according to the area of regulation addressed by their solutions reveals that KYC appears to be causing the most problems within financial institutions and are thereby deemed to offer the most attractive opportunities for investors. Since 2012, 23.1% of all RegTech investments, which amounts to $878m, can be attributed to investments in KYC solutions.

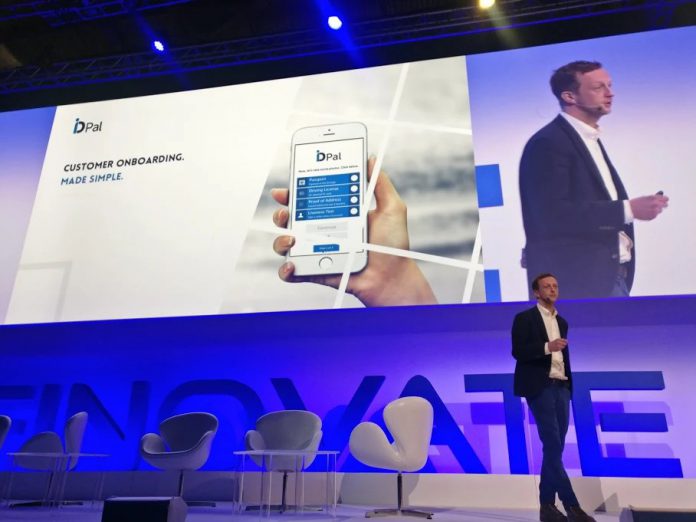

ID-Pal is an end-to-end SaaS solution for KYC compliance that enables businesses to verify the identity of their customers simply, securely and conveniently. Using advanced mobile technology, the company reduces the risk and cost associated with customer onboarding whilst removing the friction from the user experience, enabling businesses to increase top-line revenues.

“The key differentiator for ID-Pal is that we are a SaaS solution by design and intent” said O’Toole. “Most competitors in the market require significant development, integration and testing in order for a business to implement their solution. With ID-Pal, you don’t! Our flexible architecture enables a business to configure, brand and integrate ID-Pal into their onboarding process with little or no technical effort. Our seamless and intuitive user experience will be further enhanced once we launch our breakthrough innovation with reusable identity profiles later in the year.”

Copyright © 2018 FinTech Global

Copyright © 2018 RegTech Analyst