Cloud9 Technologies, which provides advanced capabilities to leverage compliance, voice analytics and workflow solutions, has closed a $30m financing round.

The round was led by JPMorgan Chase & Co, with ICAP, Barclays and Point72 Ventures also participating. It also includes principals of several leading trading firms, such as Hudson Ridge Asset Management.

Founded in 2013, Cloud9 Technologies delivers voice and collaboration services designed for the unique functional and compliance needs of institutional traders.

It connects counterparties across all asset classes via a cloud-based communication platform that features end-to-end security, encryption and advanced compliance capabilities. The startup, which claims to eliminate the infrastructure and expense associated with legacy hardware and telecommunication based solutions, has more than 2,700 users in 29 countries to date.

Cloud9 plans to use the funding to support innovation, accelerate the development of several products and expand the service offering into new markets. The company recently opened an office in Singapore to tap into the growing demand in the Asia Pacific region.

“We are thrilled to welcome Point72 Ventures and our other investors as we continue to build a technology that acts as a catalyst in terms of changing the communication and process around trading,” said Gerald Starr, CEO of Cloud9 Technologies.

“Cloud9 has ushered trader communication into the modern age, while bringing mobility, enhanced compliance and security, and more agile communication to the industry. With the close of this round, our team is poised to continue development of products and services that will change the way the financial industry and enterprise businesses communicate and collaborate.”

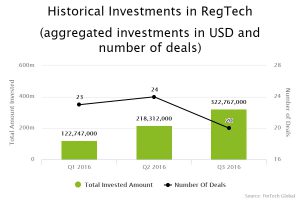

With the regulatory landscape continuing to evolve, more than $742m was invested across the global RegTech market last year according to data by FinTech Global. This year is on course to surpass the record set last year, having seen more-than $633.82 invested across the first three quarters.

Copyright © 2017 FinTech Global

Copyright © 2018 RegTech Analyst