RegTech is about bringing clarity to compliance but there is a lack of transparency between the sector and regulators, according to kompany founder & CEO Russell E. Perry.

As the pace of regulatory change continues to accelerate, technology solutions that help firms manage compliance, reduce risk and provide more agile reporting are rising in prominence in the financial services sector. Compared to 18 months ago, organisations are now starting to take a serious look at the benefits RegTech can bring. However, the rise in conversations is yet to truly translate into adoption.

kompany provides real-time access to official and audit-proof commercial register information, enabling firms to manage risks and power compliance processes. With more than 100 per cent year-on-year revenue growth, the RegTech has just brought on its first institutional investor during in its ongoing ‘eight figure fundraise’.

Founded in 2012, kompany has previously included regulators to develop its platform. However, one of the factors holding back the sector is its fragmentation according to Perry.

“You have some really good tech and some really good solutions but it’s very fragmented. You won’t find many RegTechs generating seven-figure revenues, but they have some really good tech. I have discussed this with investors and private equity firms and most are expecting this to consolidate. Everyone wants to see a group of RegTech solutions provided as a suite of services which can then be built into a platform.”

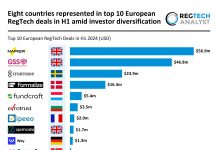

kompany itself is making plans for the consolidation and is expecting anywhere from 60-70% of European RegTech companies to merge or be acquired by the end of next year, according to Perry. Calls have been made for regulators, banks and the RegTechs themselves to do more to speed up the adoption; however, Perry sees the move as a ‘team effort’, advocating more transparency between the third parties.

“The largest financial institutions are still deciding in favour of incumbents (compliance providers) to solve their regulatory problems, but they are starting to see that these haven’t moved fast enough and are not in line with regulations such as the EU’s 4AMLD, MiFIDII or the US’s FinCen CDD. FIs don’t yet see RegTech as an enabler to service their customers better while reaching a higher level of compliance at the same time. Part of the problem is that these large financial institutions still see compliance as a cost item. That needs to be adapted.”

On the regulators side RegTechs need to be much more open and reach out a lot more than they do. “All regulators hear is tech and automation etc, there is a clear lack of transparency. Us as a RegTech community can bring in the regulators much more closely, which would result in them approving the use of solutions for financial organisations.”

“RegTech is all about bringing clarity to compliance, but I think we need to make sure we are more transparent in the way we do things.”

RegTech – More than just compliance?

Since founding in 2012, kompany has built a global network of commercial registers and government licenses in order to provide audit-proof company information. One of the biggest regulatory challenges the industry has faced is the 4th Anti-Money Laundering Directive according to Perry.

The legislation has fundamentally changed what information is required for merchant onboarding, client onboarding in corporate investment banking, and ongoing monitoring. This risk-based approach requires regulated industries to really focus on the data they use in order to qualify, onboarding and monitor their clients.

kompany focuses on business KYC, covering 150 jurisdictions and more than 100 million companies. Its audit-proof verification solution provides efficiency gains, meaning users can reduce the onboarding process from 6 months to just a few days. The solution also enables users to reduce the costs of client onboarding by a minimum of 50 per cent. Despite the solution designed to help organisations manage the compliance it also helps service their clients much quicker than their competitors.

“Due to these efficiency gains, which reduce costs and time, they become more effective when they are servicing their clients. If you have a corporate client they need to have credit decisions, bank accounts, new payment transfers etc. However, they no longer have to wait for all the paperwork and KYC to be concluded manually. Instead, these processes can be reduced down in a matter of days.”

Earlier this year, Raiffeisen Bank International (RBI) signed a contract with kompany for the development and implementation of a group-wide next-generation business KYC (Know Your Customer) solution. The KYC solution was developed by integrating multiple services into a complete and unique cloud-based platform, thus streamlining the compliance steps in accordance with RBI’s structure and business demands.

Following the deal, Johann Strobl, CEO of RBI, said the partnership is aimed at lowering the time and costs involved in achieving regulatory compliance. However, he also said that kompany gives RBI a competitive advantage in terms of better serving their business & corporate customers globally.

kompany was part of their FinTech partnership program, which is like an accelerator, according to Perry. Together they defined the blueprint of business KYC and how data can be used etc.

“During the program we adapted a few things specifically for the financial services industry,” he added. “In addition to KYC for their corporate clients, we expanded it to cover FIs. All banks have to verify each other, against each other, so we have been able to provide RBI with a platform that gives them all the relevant audit-proof data customised for some of their specific KYC requirements.”

“This means they can service their clients quicker. Instead of waiting weeks and weeks for information and validation, they can now do that service immediately, most of it can be done same day. It’s a game changer for them.”

While the financial services industry as a whole has been slow to adapt, the mid-tier banks are seeing RegTech as a great way to manage the new regulations, besides bringing in new people and hiring specialists which don’t exist in the market anymore, according to Perry.

“These mid-tier banks are having conversations with RegTechs as they see it as a way of competing with the large financial institutions. It enables them to provide their services quicker, be more efficient and are doing things at a lower cost.”

At the same time, challenger banks are putting pressure on the more traditional and established players. “The mid-tier banks are focusing on RegTech and implementing automation. They are starting to compete on their own terms with FinTechs.”

Despite being in its early days, Perry is excited about how far RegTech can grow. The technology is currently focused on the financial services industry, but its application is virtually endless as there is ‘virtually no industry segment’ which doesn’t require some sort of compliance automation, Perry added.

“We have been in talks with a coffee producer, who has the same verification requirements across the entire supply chain. So, all the logistics and supply chains from multiple industries, all have regulatory requirements they need to fulfil. As a result, the automation and the use of RegTech to ensure compliance is going to grow over the next few years outside of financial services, across all industry segments.

“From a volume and market size, RegTech can surpass FinTech really quickly. At the moment it’s a staggered approach as it’s a regulatory industry which needs to deploy technology to be more efficient and effective. We expect the logistics industry to ramp up their compliance automation next and then it will become a standard to embed RegTech into nearly every industry.”

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst