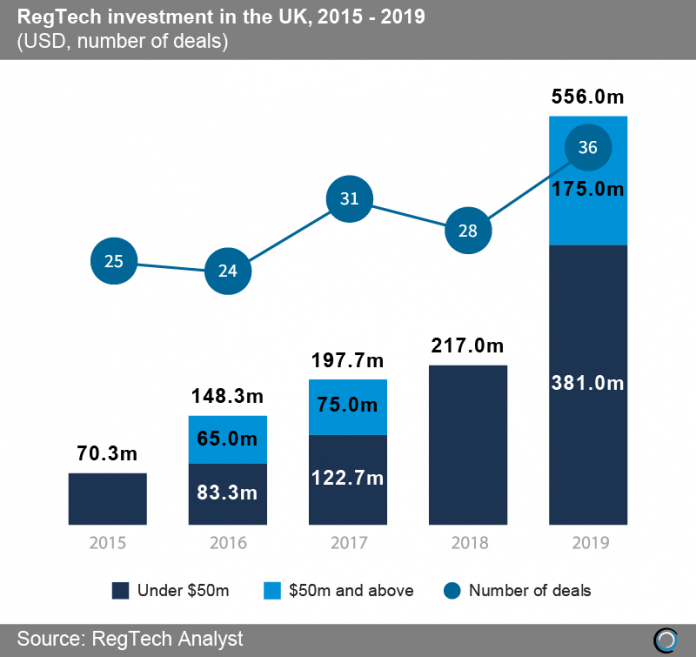

RegTech companies in the UK raised over $1.1bn across 144 transactions between 2015 and 2019, with total capital raised growing at a CAGR of 51.2% over the period. RegTech deal activity also peaked last year with 36 completed transactions.

RegTech investment more than doubled in the UK from $70.3m in 2015 to $148.3m in 2016, which was the start of the sector’s explosive growth over the five-year period. The Financial Conduct Authority (FCA), specifically its innovation arm introduced the first sandbox for FinTech in 2016, allowing companies to test their new software in a secure environment. Since then the sandbox has accepted 89 companies and has finished taking in applicants for its fifth cohort, which explains the increased investment into RegTech companies between 2016 and 2019.

The RegTech sector in the UK has shown signs of maturity with the average deal size increasing from $3.9m in 2015 to $17.9m in 2019. In one of the biggest deals in the country to date Snyk, a cybersecurity and compliance solutions provider, raised $70m in a series C round led by Accel in September 2019. The funding put the company in a strong position to rapidly expand into new markets globally and to continue pushing growth in product adoption and usage.

Copyright © 2018 RegTech Analyst