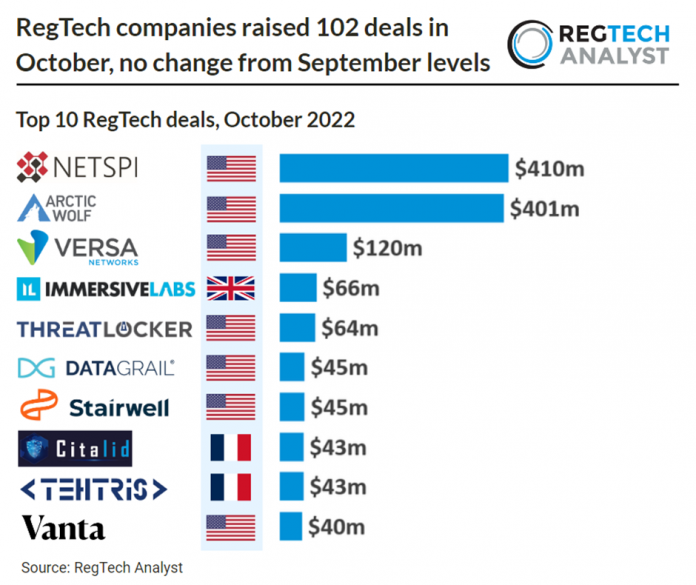

• RegTech deal activity in October remains strong with 102 deals in total, no change from the previous month. The United States was the most active RegTech country in October with a 53% share of total deals. The United Kingdom and Canada were joint second with seven deals each. RegTech companies raised $1.9bn in October, a 16% increase compared to the previous month.

• NetSPI, a penetration testing company, was the largest RegTech deal announced in ctober, raising $410m in their latest Private Equity funding round led by Kohlberg Kravis Roberts. The company intends to use the funds for technology innovation, talent acquisition, and global expansion. This new round of funding will also recapitalize Sunstone Partners’ stake in the company and allow the firm to exit. Over the past five years, the company has grown its revenue fivefold and is seeing 61% revenue growth in 2022 to date, according to the NetSPI.

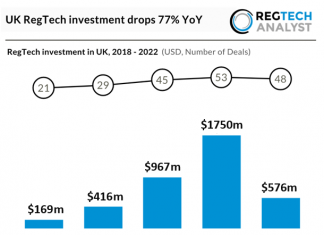

• The RegTech sector is remaining strong compared to other FinTech sectors, with both deal activity and investment seemingly unaffected by Inflation and other economic worries. FinTech sectors combined saw a 49% investment drop in the UK during Q3 2022, so why is RegTech still doing well? It comes down to the constant change in the market, new regulations and threats mean new products are created and opportunity for disruption. RegTech firms’ profit margins are also not tied with economic factors, RegTech firms can simply increase prices in line with inflation and their services will be last on the chopping block for companies looking to cut costs.

The data for this research was taken from the RegTech Analyst database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of RegTech Analyst. ©2023 RegTech Analyst

Copyright © 2018 RegTech Analyst