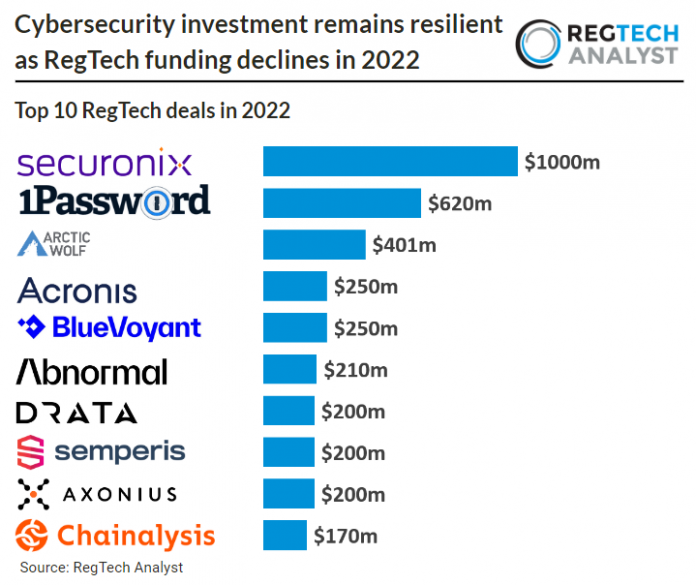

The top ten RegTech deals in 2022 as of 18 December raised in aggregate $3.5bn, a 33% drop from last year when the ten largest transactions in the sector raised $5.16bn. This is in line with the overall decline in the industry where RegTech companies raised $1.8bn in funding during the third quarter of 2022, the lowest level over the last five quarters and more than 50% lower than Q3 2021.

Cybersecurity investment remains resilient, however, with companies in the sector occupying seven spots on the list of top RegTech deals as safeguarding digital operations continues to be top priority for executives in financial services. Cybercrime is a major risk for the finance industry with organisations estimated to have increased their cybersecurity budgets by 20 to 30% in 2022. As such investors are capitalising on the increased demand by backing big companies in the space.

The biggest deal so far this year was completed by Securonix, a security analytics and intelligence platform, which raised $1bn in a Private Equity round led by Vista Equity Partners. This fresh funding gave Securonix the capital and expertise to continue its hypergrowth trajectory while meeting record customer demand, further validating its leadership position in cloud-native security analytics and operations.

The largest deal outside of North America was completed by Acronis, a Switzerland-based all-in-one cyber protection provider, which raised $250m in a Private Equity funding round led by BlackRock. The funding will be used to expand its business, including through acquisitions and hiring and pushes Acronis’ valuation to a sizeable $3.5bn valuation, growing from $2.5bn.

The data for this research was taken from the RegTech Analyst database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of RegTech Analyst. ©2023 RegTech Analyst

Copyright © 2018 RegTech Analyst