PikcioChain, a Blockchain-based exchange for personal data, has landed more than $6m ahead of its ICO launch.

The new investment has come from a variety of investors including private individuals, family offices and financial institutions.

Owned by MatchUpBox and led by Didier Collin de Casaubon, PikcioChain provides a blockchain-based exchange for personal data. The company claims to create a ‘transparent and self-regulated data trading ecosystem’, empowering businesses to trade data with confidence and in full compliance with the wishes of the data owner and the relevant regulatory environment.

Financial institutions use the technology to automate the exchange of KYC data. Its customers also include medical services, insurance companies and marketing firms.

Casaubon said, “We believe we’ve developed an exceptional and highly efficient solution for the safe exchange of verified personal data and the success of our pre-ICO fundraising indicates that investors agree.

“PikcioChain represents a giant leap forward in the storage and exchange of personal data. Its fully distributed design means data owners stay in control of their own information at all times whilst the PKC Tokens that we’re selling during the ICO, provide data owners and third-party data providers with a unique opportunity to see a financial return on the use of their personal information.”

PikcioChain, which will launch its ICO at midnight on 24 November, recently joined the BNP Paribas/Plug and Play fintech accelerator to develop a pilot project that solves a number of issues relating to the portability of data for KYC and customer onboarding purposes.

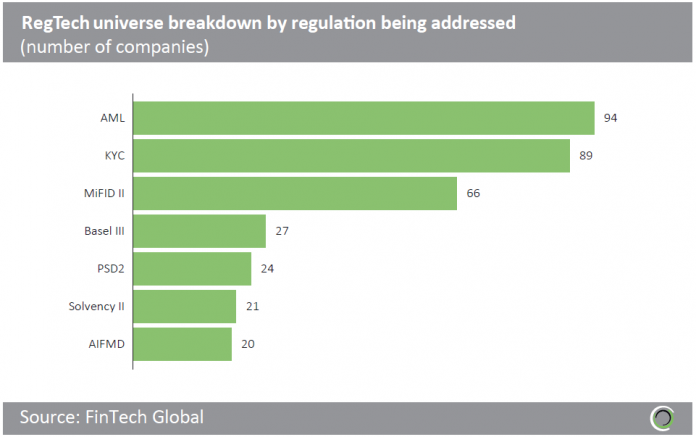

Earlier this year, the Global RegTech Review, released by FinTech Global, highlighted an increase in investments for AML and KYC solutions.

Copyright © 2017 FinTech Global

Copyright © 2018 RegTech Analyst