Apttus, a AI-powered quote-to-cash and contract lifecycle management company, has seen IBM join its Series E funding round.

The company closed its $55m Series E funding round back in September. Premji Invest led the round, which included investments from existing investors, Salesforce Ventures, K1, and Iconiq.

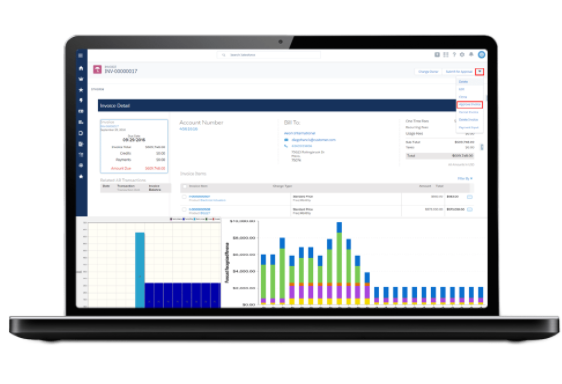

Silicon Valley-based Apttus provides the Intelligent Middle Office platform, which allows enterprises to automate and optimise their revenue and commercial relationship management processes.

Its solutions also enable compliance with current and emerging rules and regulations. Apttus technology lets enterprises design regulatory needs right into their processes, so that compliance can take place ‘with less risk, fewer manual steps and at a lower cost’ according to its website.

Following the investment, Apttus will look to integrate IBM Cloud and Watson capabilities, among other IBM technology and services. The equity injection will also be used by Apttus to further its implementation of AI-based solutions, such as revenue generation and commercial relationships management.

IBM Ventures managing director George Ugras said, “IBM is dedicated to fueling innovation and advancing how AI is implemented across industries through strategic investments and collaborations. Through this investment in Apttus, we aim to encourage creativity and entrepreneurial spirit that will drive IBM AI and cloud technologies into new applications and enterprises.”

Apttus Quote-to-Cash technology helps solve compliance with ASC 606/IFRS 15 revenue recognition rules by transforming revenue management processes, automating dual reporting of revenue, reducing the cost of revenue recognition and eliminating reliance on manual efforts and spreadsheets.

With financial institutions facing a host of emerging rules such as MiFID II, Know-Your-Customer, Ring-fencing and General Data Protection Regulations, Quote-to-Cash solutions also ensures internal access controls, compliant pricing arrangements, accurate contract language, simplified contract amendment procedures and all required reporting.

Its Contract Management platform claims to simplify Dodd-Frank identification of vendors for fast annual reporting. It enables banks to consolidate contracts into one searchable repository, flag relevant language, and issue reports automatically.

Last year, Apttus made several new hiring’s, with the company appointing former-Imperva CFO Terry Schmid as its new CFO. In the same month, the company added former Cisco Systems EVP and CMO Sue Bostrom and Veeva Systems CFO Tim Cabral to its board of directors.

Copyright © 2018 FinTech Global

Copyright © 2018 RegTech Analyst