Digital money platform Uphold has received an $57.5m funding from a group of investors, including Greg Kidd.

Alongside the transaction, Kidd’s investment vehicle Hard Yaka will support the creation of Uphold Labs, which will help accelerate the R&D efforts to its consumer and partner solutions.

Uphold is a digital money platform that offers a safe environment to access currencies, cryptocurrencies and other investments in a single location. Through the platform, users are able to move, convert, and hold currencies and send them anywhere around the world.

The remittance app, which is used across 184 countries and over 20 different currencies, is fully compliant ensuring correct measures are implemented for regulations like KYC and AML.

The company also offer full compliance with Office of Foreign Assets Control (OFAC) regulations. Including real-time identification and investigation of unusual activity, and suspicious activity reporting.

It also offers currency transaction reports and other reporting requirements triggered by transaction volumes and specified activity patterns as articulated in the Bank Secrecy Act (BSA). The company also claims to offer compliance with BSA record keeping requirements, and compliance with lawful requests for information from law enforcement with the authority to make such requests.

Uphold CEO Adrian Steckel said, “This is a landmark partnership for the crypto market. We have always provided our Members with unparalleled transparency and safety, as well as the greatest choice of currencies, now we’re also giving them unprecedented asset protection.

“This collaboration will also enable us to accelerate our product development activities, focusing on adding new assets, more connectivity to financial systems, as well as blockchain and Ripple-centric projects.”

The digital gift card and prepaid payments network Blackhawk was acquired by Silver Lake and P2 Capital Partners earlier in the year.

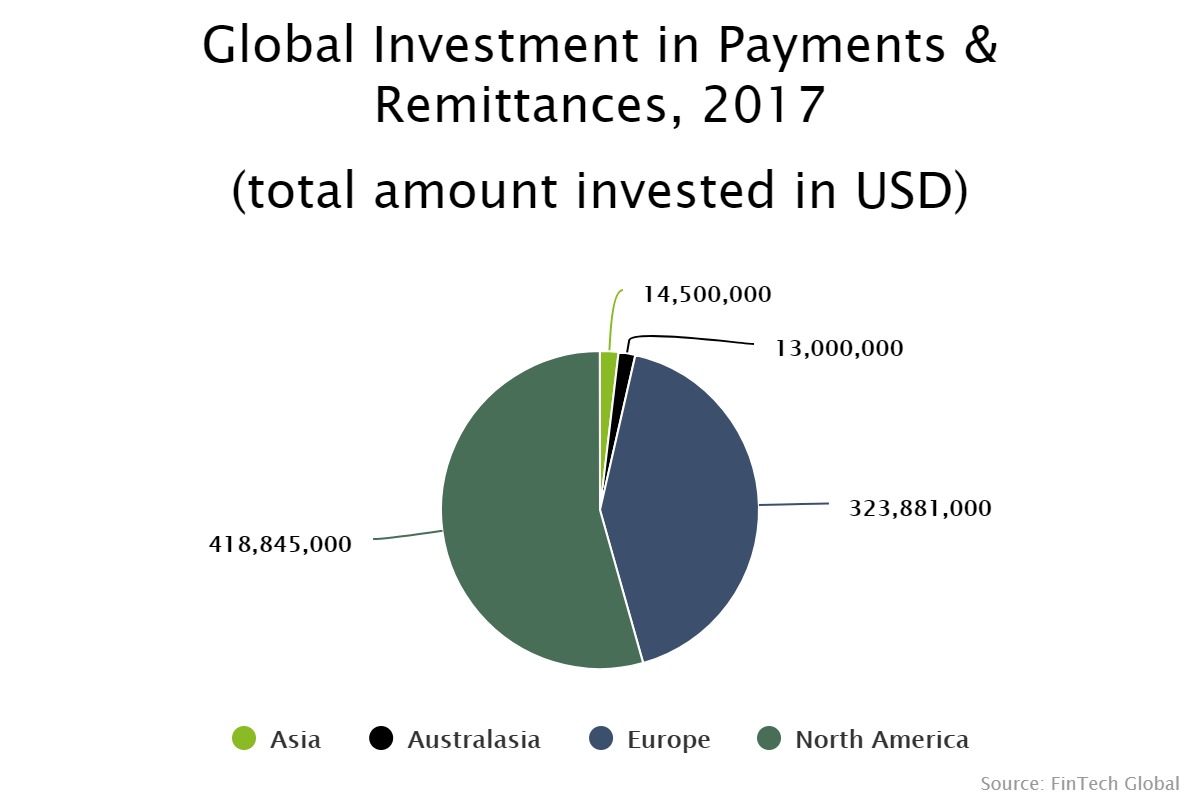

Last year, the remittance sub-sector of the payments vertical was dominated by the North American market, with the region accounting for around 55 per cent of the total investment in the space. The next biggest market for remittance companies was Europe, which represented 43 per cent of all funding.

Copyright © 2018 RegTech Analyst