San Francisco-based Deciens Capital has set an $80m goal for its 2018 fund.

Although no capital has been registered, a filing with the SEC lists Global Alliance Securities as a placement agent for the fund. The firm targets FinTech investments, backing companies in sectors including payments, lending, insurance, RegTech, risk management, capital markets, trade finance, personal finance, savings and marketplace businesses, according to its website.

Its previous investments includes Fuze Networks (acquired by IngoMoney), Sponsor hub (acquired by RentTrak), Simple legal, Keychain Logistics, Wevorce, True Link, Workhands, 7 Cups of Tea, SubLedger and Clara

Deciens Capital was founded in 2012 by Daniel Kimerling and Zachary Townsend, who will both manage Deciens Capital Fund 2018, the filing states.

Kimerling was previously head of API banking, open platform and R&D at Silicon Valley Bank. He was responsible for all aspects of API banking – including sales, marketing, technology – and carry its P&L. As part of this, he lead its open platform strategy and go to market.

Before founding Deciens Capital, Townsend was chief data officer for the state of California. He had statewide responsibility for three key initiatives based on data collected in the normal course of state business to improve transparency, efficiency, and accountability in state operations.

The pair previously co-founded Standard Treasury, a API banking startup, which was purchased by SVB in August 2015. Standard Treasury was a Y Combinator-backed company and a graduate of the SVB and MasterCard accelerator, Commerce.Innovated.

Earlier in the year, B Capital raised $360m for a new fund, which will primarily focus on technology within the financial, insurance and healthcare industries. The firm has invested in a selection of FinTechs, having supported contract management company Icertis’ $50m Series D and SME loan provider Capital Match’s undisclosed round.

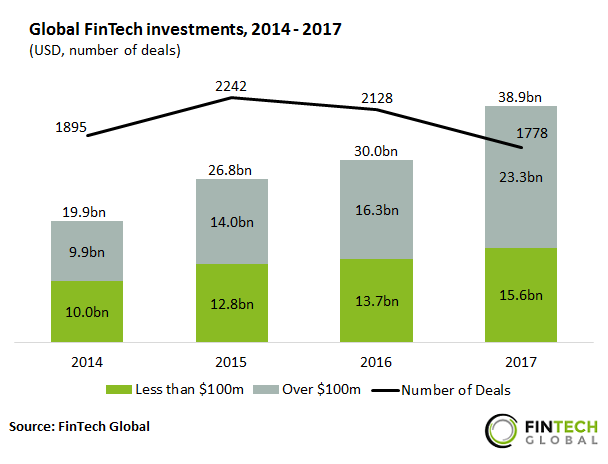

The fundraise comes as investments in the FinTech sector continue to grow, with last year seeing the third consecutive year for a rise in funding. Last year, a total of $38.9bn was deployed to FinTechs around the world, which is almost double the amount invested in 2014.

Copyright © 2018 RegTech Analyst