Core banking developer Ohpen has closed a €25m Series C funding round from private equity firm Amerborgh.

Founded in 2009, Ohpen is a cloud-based banking engine created to help improve administration of retail investment and savings accounts. Offerings also include payments processing, order and fund management, investment accounts and audit, risk and fraud management services, robo-advice and reporting.

Its audit, risk and fraud management Module contains all necessary features such as market abuse, unusual transactions, prevention of terrorism financing, anti money laundering and suspicious payments according to its website. While its reporting & analytics module includes numerous standardised and custom reports for all departmental needs, including: operations, risk, client services, tax, and general reporting.

The Netherlands-based company is used by banks, asset managers and insurance companies to improve their core banking platforms.

Capital from this round will be used to support the growth and expand its operations in to a third country. Ohpen will use the equity to build a team for the third market and make the necessary changes to the platform for it to work in the new market. The company is exploring to deploy in either Germany, France, Canada, Australia or the US, and will make a decision by the end of Q1.

Ohpen founder and CEO Chris Zadeh said, “We’re just scratching the surface. Ohpen is changing the core banking software industry, advocating a totally digital solution that is based on one version of the platform for all clients and countries. This has never been done before: it requires creativity, commitment and also the necessary capital to implement our vision.”

This funding comes after the company doubled its staff and revenue in 2017, and launched a partnership with Aegon Bank and de Volksbank. Last year, Ohpen closed a €15m funding round to support its expansion in to the UK market.

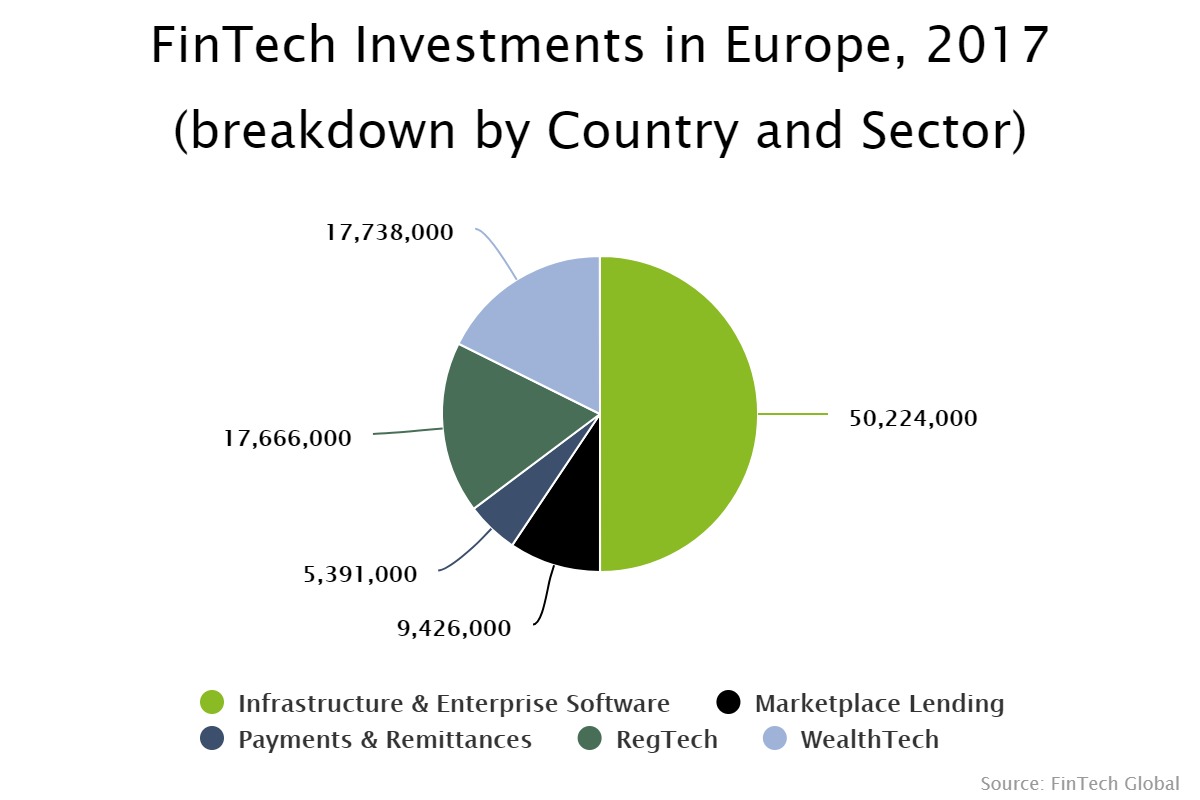

Last year, half of the funding in to the Netherlands FinTech sector went to companies focusing on infrastructure and enterprise software solutions. The sector saw $50m deployed, while the next biggest area was WealthTech, picking up $17m.

Copyright © 2018 RegTech Analyst