Valor Capital, a firm focused on US and Brazil cross-border opportunities, has raised up to $56m for its second venture capital fund, which has a goal of $100m.

So far, the vehicle has received contributions from 50 accredited investors, according to the latest US Securities and Exchange Commission filing. It is unclear in the document if the $100m figure is a target or hard cap.

An initial filing for this vehicle was released early last year and had not reported any capital to be invested at that point.

With offices in New York, Silicon Valley and Brazil, Valor Capital looks to invest through both growth equity and venture capital strategies. It looks to support US and international technology businesses that are aiming to expand into Brazil.

The firm invests across the FinTech, cybersecurity, education, health and wellness and logistics industries.

Its current portfolio includes Fortscale, which helps security professionals by automating insider threat detection and investigation. Fortscale’s User Behavior Analytics (UBA) solutions combine expertise from the Israeli Defense Force’s elite security unit, advanced machine learning, and big data analytics to create a solution that provides rapid detection and response to malicious user behaviors. In February 2017, the company secured $7m in a funding round led by Evolution Equity Partners and Valor, bringing Fortscale’s funding total to $23m.

Valor’s previous investment in Cybersecurity space also include Illumio, a data center and cloud security company led by veterans with deep experience in virtualization, networking and security hailing from industry leaders. Illumio’s Adaptive Security Platform (ASP) is completely independent of underlying infrastructure and delivers visibility and control over workloads running in any data center or cloud environment. To date, the company has raised more than $267m.

Its current portfolio also includes digital currency wallet Coinbase, personal finance platform GuiaBolso, payment processor Stone.

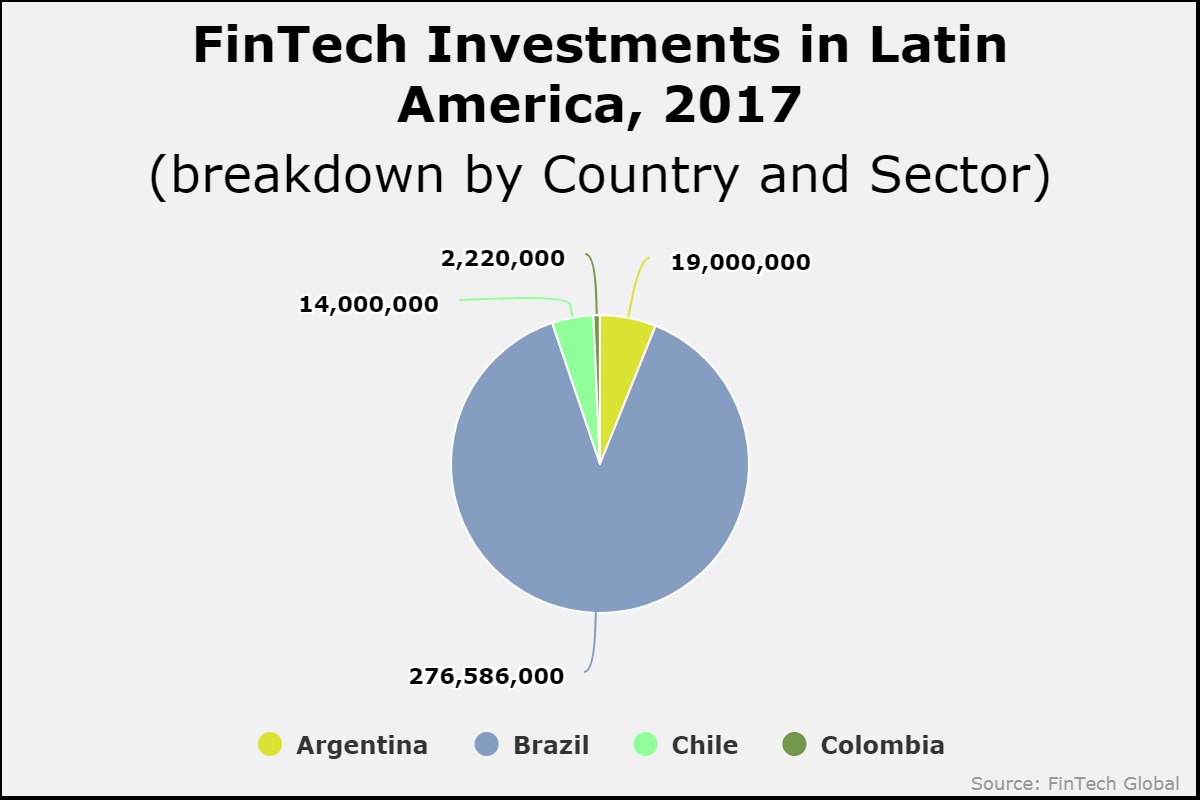

Brazil led the way for funding in the Latin America FinTech sector last year, according to data by FinTech Global. The country was responsible for 89 per cent of the total $311m that was invested into the country in 2017.

Copyright © 2018 RegTech Analyst