The regional shift in RegTech deals from US to Europe is continuing to other regions

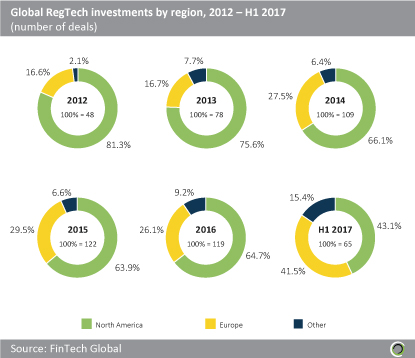

There has been a significant shift in the centre of gravity of global RegTech investments since 2012. Although the number of deals in North America continues to increase, the region has seen its share of the total drop by almost half, from 81.3% in 2012 to 43.1% in H1 2017.

Europe has increased its share by around 2.5x over the same period from 16.6% to 41.5%, while other regions, primarily Asia, have increased their share from 2.1% in 2012 to 15.4% in H1 2017.

Prior to 2015, the ‘Other’ category was defined purely by Israel and Asia, however, other parts of the world entered the race in 2015 with a 1.6% share which has increased to 4.6% in H1 2017. New initiatives from regulatory authorities in the Middle East and the rise of RegTech deals in Australia and Brazil have driven this increase.

The average deal size in the Middle East & Israel has surpassed the average in North America

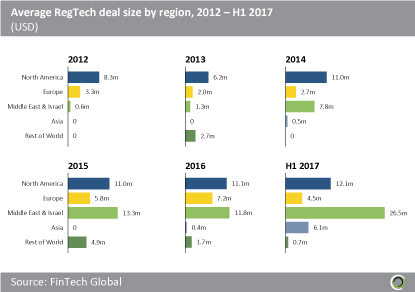

A drill-down into the global average deal size for RegTech investments shows North America had the highest average deal size between 2012 and 2014, which is unsurprising given that the US RegTech investment market is relatively more mature than anywhere else.

The highest growth of average deal size appears to be occurring in the region covering the Middle East & Israel. This is due to a smaller sample size being skewed by a few large deals. There have only been nine deals in the region between 2015 and 2017, and two companies have been the main cause for the high average in these years. Riskified, a fraud detection company, has been the biggest contributor to the growth in deal size across the region, having pulled in $58m in the past two years from nine investors.

The other main contributor to the high average is VAT management platform VATBox, which raised $44m between August 2015 and February 2017. The company attracted investments from Target Global and Viola Growth.

The impact of a small number of larger deals on the average of a small sample size also explains the variations in average deal size for Asia, where the $6.1m Perfios Software Solutions was the only significant deal in H1 2017.

The US has been home to around two thirds of all RegTech deals since the beginning of 2012

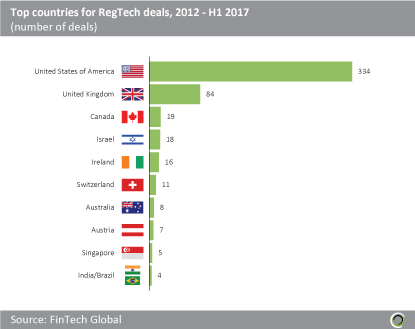

The US has been the most active region for RegTech investments by far: almost twice as many deals were completed in the country since 2012 than for the next nine countries in the top ranking combined. External investments varying from as little as $16k to as much as $96m were made in 334 deals.

The UK follows in second place with 84 deals, which is in line with the size of the country’s financial services industry relative to others.

Canada, Israel, Ireland and Switzerland have all reached double figures in terms of external investment rounds into RegTech companies, underlining the emergence of these countries as centres of RegTech innovation.

Australia and Austria are in seventh and eighth place having made 15 deals between them. Singapore, India and Brazil occupy the last three places with 13 deals between them since 2012.

Copyright © 2017 RegTech Analyst

Copyright © 2018 RegTech Analyst