Capital invested in global RegTech companies has tripled over five years

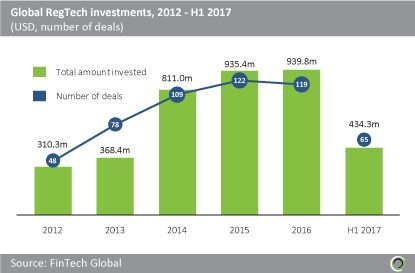

Global RegTech investments have tripled over five years from 2012 to 2016. An increase of 32% CAGR, in terms of capital invested, has seen the level of recorded capital increase from $310.3m to $939.8m. The number of investments peaked in 2015 when 122 deals were recorded compared to 48 in 2012. The total number of deals and the aggregate capital investment remained steady between 2015 and 2016. The first half of 2017 has

seen $434m invested in 65 deals compared to $350m in 58 deals in H1 2016, indicating that 2017 could see a record year for RegTech investments.

Of the five years, 2016 saw the most amount of capital invested, even though it did not register the most deals. Investment capital reached a total of $939.8m in 119 deals, compared to $935.4m in 122 deals in 2015. The rise in funding last year was bolstered by several high value investments including Avalara’s $96m funding round.

The investment into Avalara is the second biggest RegTech deal to date and is beaten only by the company’s $100m private equity financing from Warburg Pincus in 2014. Other big contributions to last year’s totals were Pindrop’s $80.7m Series C round, Skyhigh Networks’ $40m Series D round and Digital Reasoning’s $40m Series D investment.

Early-stage deals are increasing in size

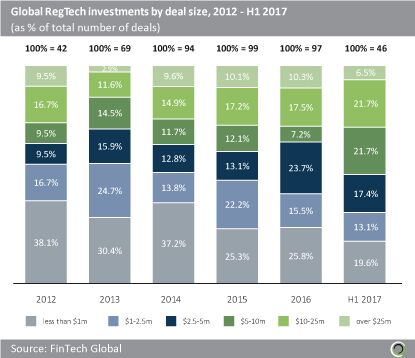

Although the average deal size at global level has not varied much since 2014, the distribution of deals by size has shifted upwards within the $0-5m range. Investments in the interval below $1m dropped as a share of the total from 38.1% in 2012 to 25.8%

in 2016. The first half of 2017 witnessed a continuation of this trend with the sub-

$1m interval halving as a share of the total, compared to 2012.

Between 2012 and 2016 the decline in share of sub-$1m deals was taken up by deals in the $2.5-5m range which increased their share by around 2.5x from 9.5% to 23.7%. Hence it appears that earlier-stage RegTech deals are raising larger amounts. The first half of 2017 has seen another shift up in deal size: compared to 2016, deals between $5-10m tripled from 7.2% share to 21.7%.

Although the step up in deal size implies a maturing of the industry, deals above $25m are still a relative rarity, accounting for around a 10% share between 2014 and 2016.

Risk management has seen the most significant change in terms of number of deals over the last five years

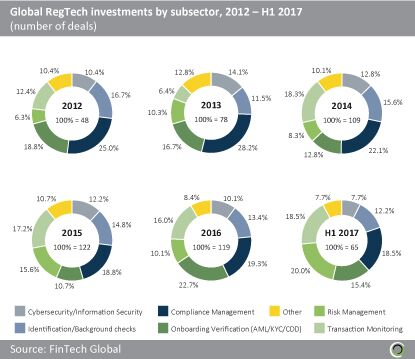

The relative dominance of individual subsectors as a percentage of the total number of RegTech deals has waxed and waned over the past five years for every subsector except compliance management, which declined from 25% in 2012 to 18.5% in H1 2017. A comparison of 2012 to H1 2017 does, however, clearly show a marked increase in the share of risk management deals which rose from 6.3% to 20% over this period. This is in line with the fact that more legislative changes over the period have impacted risk management in some shape or other than any other part of the RegTech value chain.

Copyright © 2017 RegTech Analyst

Copyright © 2018 RegTech Analyst