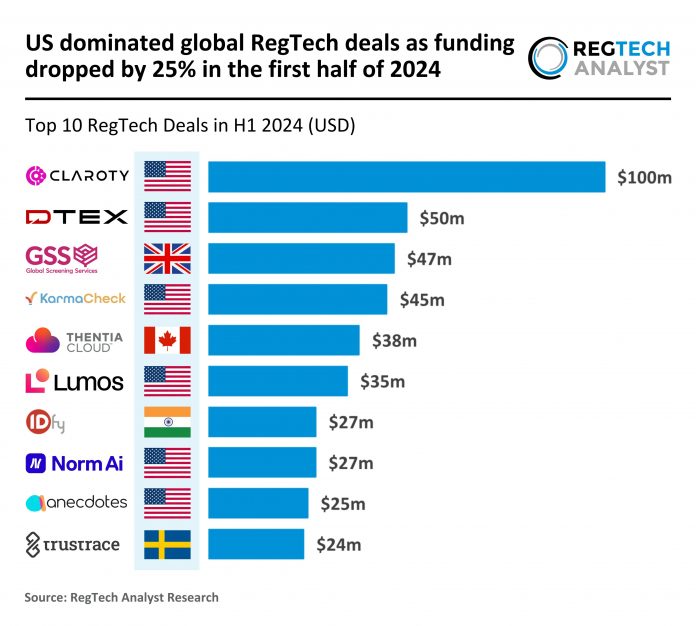

Key Global RegTech investment stats in H1 2024:

- Global RegTech funding dropped by 25% in H1 2024 YoY

- US asserted its dominance in the market by securing 60% of the top 10 deals

- IDfy secured a $27m funding round to be the only Asian country featured in the top 10 deals for H1 2024

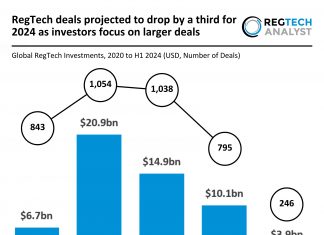

In H1 2024, the global RegTech sector recorded 246 transactions, marking a significant decline of 45% from the 444 deals completed in the same period in 2023 and a 30% drop from the 351 deals in H2 2023. Despite the sizeable drop in deal volume, the total investment raised did not experience as much of a sharp drop, with the total RegTech funding in H1 2024 amounted to $3.89bn, reflecting a 25% decrease from the $5.16bn raised in H1 2023 and a 22% drop from the $4.98bn raised in H2 2023. This notable decrease in funding and deal volume suggests an industry-wide contraction, potentially driven by investor caution and macroeconomic uncertainties affecting the RegTech sector.

The top 10 deals in H1 2024 were dominated by the United States, which secured six top deals, mirroring its position in H1 2023. However, there were notable shifts in the other top countries. India, Sweden and Canada appeared on the list for the first time, with one top deal each. In contrast, the Netherlands, Israel, and France, which had each secured one top deal in H1 2023, were absent from the H1 2024 list. The United Kingdom maintained a presence in both periods, reflecting its continued strength in the RegTech space, while the changing country mix underscores the evolving geographical distribution of large deals within the sector.

Mumbai-based IDfy, a leader in fraud prevention and trust establishment, marked a significant milestone by securing a $27m fundraise, making it the only Asian company to feature in the top 10 RegTech deals for the first half of the year. Backed by Elev8, KB Investment, and Tenacity Ventures, this round of funding supports IDfy’s mission to combat fraud through AI/ML-powered verification solutions, performing over 2 million verifications daily. Founded in 2011, IDfy serves over 1,500 clients across sectors like BFSI, e-commerce, and FMCG, with a client list that includes major names like HDFC Bank, Zomato, and American Express. The funds will further enhance IDfy’s expansion and product development, solidifying its presence across India, Southeast Asia, and West Asia.

Keep up with all the latest RegTech news here

Copyright © 2024 RegTech Analyst

Copyright © 2018 RegTech Analyst