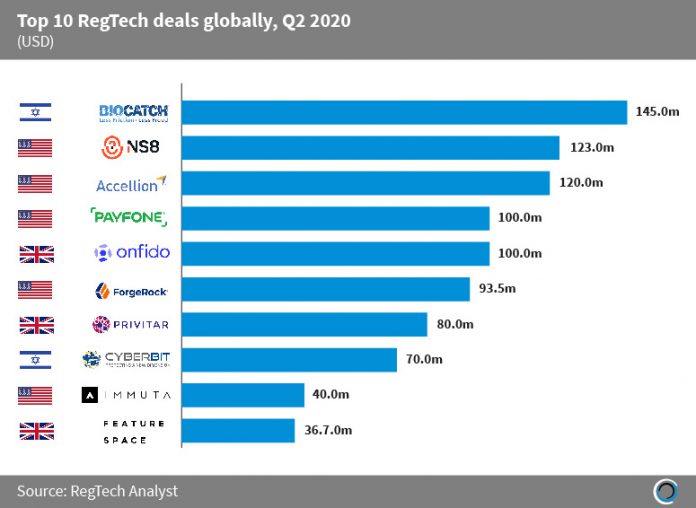

The top ten RegTech deals in the second quarter of the year raised $908.2m in aggregate. This a significant slowdown compared to the $1.7bn raised in the ten largest transaction during the first three months of 2020 as the coronavirus uncertainty makes investors cautious of writing big cheques.

US companies completed five transactions on the list with NS8, a fraud prevention platform leveraging behavioural analytics to help minimise online risk, closing the largest round in the country. The company raised a $123m Series A round led by Lightspeed Venture Partners and AXA Venture Partners and will use the fresh capital to accelerate the development of its product and increase its global reach, including expanding its partner network.

However, the top deal during the period was completed by BioCatch, an Israeli behavioural biometrics platform helping financial institutions protect their clients from fraud and other criminal activities. The company raised $145m in a Series C round led growth investor Bain Capital Tech Opportunities in April. With the new funding the company will look to broaden its product offerings and expand into new verticals.

Copyright © 2018 RegTech Analyst