Tag: financial institutions

Bitsight acquires Cybersixgill in $115m deal to enhance cyber threat intelligence

Bitsight, a global leader in cyber risk management, has announced its $115m acquisition of Cybersixgill, a prominent cyber threat intelligence (CTI) provider.

FinCEN issues alert on deepfake fraud schemes targeting financial institutions

The U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) has issued a critical alert to assist financial institutions in identifying and addressing fraud schemes involving deepfake media created with generative AI (GenAI) tools.

Five key benefits of moving financial crime compliance to the cloud

As financial institutions navigate an increasingly complex regulatory environment, many are finding that cloud technology offers a reliable solution for future-proofing compliance efforts. The move to cloud-based financial crime compliance not only enhances agility but also helps institutions meet stringent regulatory requirements more effectively.

Banks and credit card issuers face rising fraud cases, but proactive...

Fraud protection and resolution are becoming essential components of the customer experience in banking, particularly as financial fraud rates continue to rise.

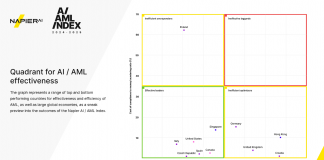

New Napier AI report highlights $3.13trn potential savings with AI in...

Napier AI, a RegTech company offering a range of compliance tools and services, has launched its inaugural AI / AML Index, revealing that artificial intelligence could enable global economies to save $3.13trn annually by enhancing the detection and prevention of money laundering and terrorist financing.

How automation transforms regulatory compliance in finance

In today's evolving regulatory environment, financial institutions are increasingly turning to technology to manage their regulatory lifecycles effectively.

According to Ascent, automation is becoming...

Tookitaki’s anti-financial crime technology garners investment for growth in key Asian...

Tookitaki, a leader in anti-financial crime software, has recently secured a strategic investment from True Global Ventures (TGV) Opportunity Fund.

Unlocking business success: How KYC enhances financial security in Mexico

KYC regulations serve as a critical safeguard in Mexico, a country identified by the U.S. Department of State as a major conduit for laundering money derived from drug trafficking, corruption, and other illegal activities.

Mastering KYC compliance: Strategies for Australian businesses

In today's digital landscape, the importance of identity verification extends beyond mere procedure; it's a critical safeguard against escalating fraud risks.

QuantCube Technology unveils asset mapping database for enhanced ESG risk compliance

QuantCube Technology today unveiled its innovative Asset Mapping database, engineered to bridge the critical data gap faced by banks, insurance firms, asset managers, and corporations.