Tag: financial crime.

New Napier AI report highlights $3.13trn potential savings with AI in...

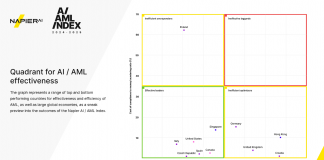

Napier AI, a RegTech company offering a range of compliance tools and services, has launched its inaugural AI / AML Index, revealing that artificial intelligence could enable global economies to save $3.13trn annually by enhancing the detection and prevention of money laundering and terrorist financing.

Key strategies to maximize efficiency in AML case management

In today's rapidly evolving FinTech landscape, the capacity to effectively manage a growing volume of financial transactions is paramount, particularly with the rise in digital transactions.

Salv’s new e-book explores why collaboration is key in the battle...

A new e-book, co-created by Salv, Thistle Initiatives, and We Fight Fraud, offers a deep dive into the mechanics of APP (Authorised Push Payment) fraud, providing readers with a view from the victim’s perspective.

Harnessing technology for efficient financial crime investigation

In the realm of financial crime investigation, government officials are inundated with a vast amount of data that demands meticulous scrutiny. Available databases are packed with critical data on beneficial ownership, corporate structures, and various risk indicators, such as those associated with shell companies and financial performance.

UK, France and Germany continued to dominate European RegTech investments in...

European RegTech investment stats in H1 2024:

UK, France and Germany retained top 3 spots for the most active RegTech markets based on number...

Overcoming barriers in the UK’s private investment landscape

The UK stands as a prime hub for venture capital within Europe. However, the private investment scene has recently seen a downturn, exacerbated by economic instability and inflatory pressures.

Featurespace and OrboGraph unite to combat rising check fraud with advanced...

Featurespace, a global fraud and financial crime prevention firm, has entered into a strategic partnership with OrboGraph, a leading provider of check processing automation and fraud detection software and services.

Napier AI’s call for smarter CDD practices in HM Treasury’s latest...

Napier AI has responded to a consultation from HM Treasury, the UK government's economic and finance ministry, on enhancing the effectiveness of the Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017 (MLRs). These regulations require businesses to identify and prevent money laundering and terrorist financing.

Navigating KYC and KYB: Essential strategies for regulatory compliance in FinTech

In the realm of FinTech, understanding the nuances between Know Your Customer (KYC) and Know Your Business (KYB) is essential for businesses navigating the complexities of regulatory compliance and risk management. Both KYC and KYB processes are foundational in building trust and ensuring financial integrity within companies.

Navigating regulatory challenges amidst shifting global trends

As 2024 progresses, regulators worldwide find themselves increasingly busy, grappling with the dual challenges of an ever-changing geopolitical landscape and the rapid evolution of...