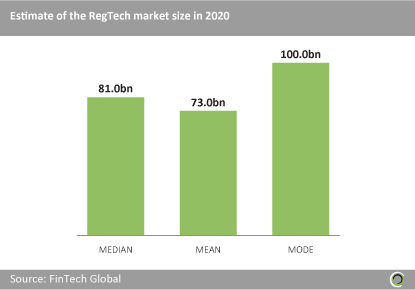

The size of the global RegTech market in 2020 is estimated to be $73bn

Estimates for the size of the RegTech market are often guesses based on estimates of the amount of money major financial institutions spend each year on compliance activity, software and external compliance-related services. Some estimates supposedly extrapolate a figure from the total fines applied by regulatory authorities on major financial institutions over the last few years.

In our view, a more informative way of assessing the market for RegTech solutions is to gain a consensus estimate from active RegTech companies that are actively competing to take a share of it. The advantage of this method is that it effectively incorporates the thinking and analysis inherent within the business plans of the RegTech companies as well as the investment plans of the venture firms and other backers of those RegTech companies.

The consensus view on the size of the RegTech market in 2020, obtained from forecasts provided by the RegTech 100 companies, gives a mean estimate of $73bn, a median of $81bn and a mode of $100bn. In our opinion the best estimate of the size of the RegTech market is $70-80bn. Our definition of the RegTech market is the annual revenue that will be spent in 2020 on regulatory software and directly related services.

It does not include consulting, advisory or compliance services.There is of course an inherent bias in any approach to determining a market size estimate. The investors and companies involved in the RegTech market have a vested interest in taking an optimistic view on the prospects for their companies, which is aided by assuming the largest market possible. What’s more important, however, is to assess the order of magnitude of the size of the opportunity and in this sense it is clear that the RegTech market is worth several tens of billions of dollars and possibly around a hundred billion. Even if the actual market turns out to be half the size or twice the size of the consensus estimate, it is large enough to justify hundreds of millions of dollars in investment into RegTech companies and within financial institutions.

The total staff at RegTech 100 companies is expected to grow by 8.3% CAGR over five years

The RegTech 100 illustrates that innovation is unrelated to size in terms of employees. Three quarters of the companies have less than 50 employees and just over one quarter have less than ten employees. The distribution of company size by number of employees correlates quite strongly with the age profile of companies in the industry. Many young RegTech companies are at a stage where their solutions are advanced enough to demand the attention of financial institutions, even though they have yet to undertake significant headcount growth.

Companies in the RegTech 100 are obviously confident about growing their companies and adding staff members at a rapid rate over the next five years.

A comparison of the expected headcount figures for 2022 compared to the actual figures in 2017 illustrates this rapid growth. The number of companies that have 50 or less employees drops from 76% to 31%. All other employee intervals are expected to increase: companies with 51-100 employees increase from 15% to 26%; 101-250 employees from 6% to 28%, 251-500 employees from 2% to 11% and companies with 500+ employees quadruple from 1% to 4%.

RegTech 100 companies anticipate average revenue growth of 61.4% CAGR over the next five years

All RegTech companies are aiming for rapid growth over the next five years. Leaving aside the fact that some companies will actually cannibalize the growth of others, an aggregation of the expected revenue growth rates of the companies gives a strong indication of the potential speed at which the market may grow.

A comparison of estimated revenue in 2022 compared to actual revenue figures in 2017 indicates the high level of optimism. Companies that currently generate annual revenue of up to $5m comprise 81% share of all companies in 2017 but occupy only a 6% share in 2022.

All segments for revenue generation above $5m increase in size: companies generating $5-10m increase from 9% to 15% share; $10-20m from 6% to 19%; and companies generating more than $20m increase from 4% to 60%.

Overall, an aggregation of the data from RegTech 100 companies gives an average growth rate of 61.4% CAGR over the next five years.

Copyright © 2017 RegTech Analyst

Copyright © 2018 RegTech Analyst