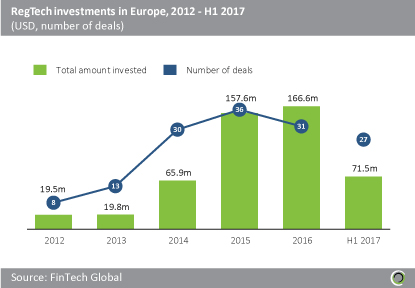

Annual investment in European RegTech companies increased 8.5x between 2012 and 2016

European RegTech investments have increased more than 8.5-times between 2012 and 2016. In 2012 $19.5m was invested across just eight deals, while the following year saw $19.8m split over 13 deals. The biggest deal in 2012 was a $15m financing round to London-based compliance company OpenGamma, with Nex, Accel Partners, FirstMark, and Euclid Opportunities all participating in the round. A year later, the biggest deal was only $5.4m with Dublin-based Fenergo closing a venture round, led by Ulster Bank Diageo Venture Fund and Investec.

The amount of capital invested in European RegTech companies reached a record high in 2016 by hitting the $166.6m mark, with the money spread across 31 deals. Two of the largest deals in 2016 came from London-based startups. Technology-enabled identity verification platform Onfido closed a $25m Series B financing, collecting capital from Idinvest Partners, Wellington Partners and Salesforce Ventures, among others. Real-time risk management company OpenGamma closed a $13.3m Series D, led by Accel Partners and ICAP. The amount of capital invested in 2016 was a slight increase on 2015, which reached $157.6m, and nearly three times the $65.9m invested in 2014.

In the first half of 2017, $71.5m was invested in RegTech companies in Europe, which is more than three-times the amount the continent saw in the whole of 2012 and 2013. The 27 deals completed in H1 2017 is not far off the total of 31 deals across the whole of 2016.

European RegTech moves towards larger deals

A simple comparison of the average size of deal can be misleading. For example, the comparison of H1 2017 to H2 2016 gives a much smaller average in the latter half-year. The percentage of European RegTech investments valued below $1m has dropped dramatically over the past five years, falling by 40%. The data shows that in 2012, 66.8% of the deals completed sat in that bracket. Contributing to this were companies like Contego, which raised $629k and Onfido, which collected a $300k seed financing round. Four years later (2016), the share had dropped to 26.1%. For the first six months of 2017, the figure dropped even further to 18.8%.

Deals in the $2.5-5m bracket increased from 20% in 2013 to 26.1% in 2016. More significantly the percentage of deals in the $10 to 25m range has also increased since 2013, reaching 13% of the overall investment in 2016. Last year’s shift to larger deals was propelled by OpenGamma collecting $13.3m in Series D financing.

Investors are backing all subsectors of European RegTech

An analysis of European RegTech deals by subsector since 2012 shows continuous variation in terms of which subsectors attracted the most deals or the most capital. The data for 2016 shows that over a third of deals and 23% of capital went to companies specialising in the onboarding verification subsector. Companies in this subsector have attracted a lot of investment interest in the past, receiving more than an 80% share of deals or capital in previous years.

In 2016, the cybersecurity/information security subsector attracted the most capital with 42.9% of the total funding going into a 19.4% share of total deals closed. This is the most rapid growth shown by any subsector as no significant deals were completed in this segment prior to 2015.

The data for H1 2017 shows a change to the previous year, but the fluctuation should be seen as indicative of the appeal of other subsectors in addition to those that saw the most deals in previous years, rather than a major shift away in investor interest. The large shifts between subsectors are partly due to the relatively small sample size, but it is clear that the transaction monitoring subsector is seeing renewed interest, with 36.6% share of capital and 14.8% share of deals. This year also saw renewed interest in risk management companies, which accounted for a third of deals and 21.2% of total funding.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst