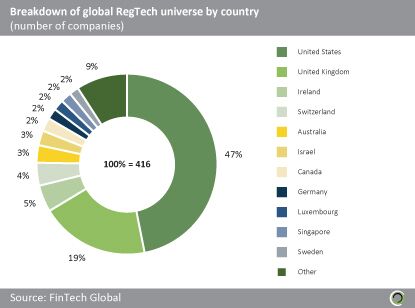

Three quarters of the world’s RegTech companies are based in four countries

Forty-seven per cent of RegTech companies globally are headquartered in the United States, while 19% are based in the UK. Four countries – US, UK, Ireland and Switzerland, account for three quarters of all RegTech companies worldwide. Other prominent countries with active RegTech innovation scenes include Canada, Austria, Germany, Luxembourg, Sweden, Israel and Singapore.

More countries are expected to emerge within the global RegTech landscape as incubators and regulatory sandboxes are being setup in other parts of the world, such as the Middle East and Asia.

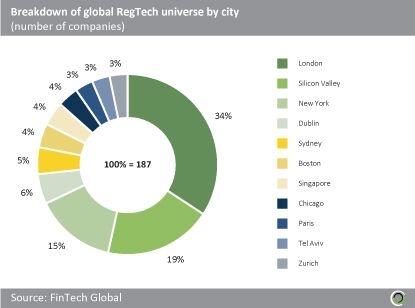

London is home to more RegTech companies than any other city

At the city level, more RegTech companies are located in London than anywhere else, with a third of all RegTech companies in the world having their HQ in the city. Silicon Valley houses a fifth of the total, followed by New York which is home to 15% of all RegTech companies.

The common factors that drive RegTech innovation in any particular city comprise an established technology hub, an active financial service industry and a supportive regulatory authority. Among other cities that are actively providing the right environment are Dublin, Sydney, Boston, Singapore, Chicago, Paris, Tel Aviv and Zurich.

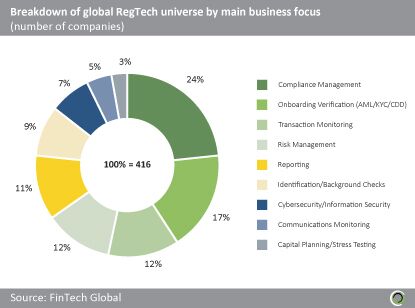

Half of all RegTech companies are focused on compliance management, onboarding or transaction monitoring

Analysis of the main area of operation for every RegTech company shows that nearly a quarter are focused on compliance management.

Although virtually every area of operation within the RegTech value chain could be covered by the broad term ‘compliance’, in this context ‘compliance management’ refers to the overseeing of staff and company activities to ensure they adhere to compliance rules. Hence a considerable number of RegTech solutions incorporate or interact with the compliance management function.

The other main areas of operation include onboarding verification (17%),

risk management (12%), reporting (11%) and identification/background checks (9%).

Since many RegTech solutions affect more than the one key area, the actual number of offerings that affect each area will be higher than implied by Figure 7.

Copyright © 2017 RegTech Analyst

Copyright © 2018 RegTech Analyst