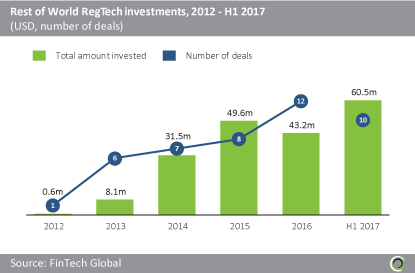

Rest of World RegTech investments have grown by 100x since 2012

H1 2017 saw a record level of investment into RegTech companies based in the “Rest of World”, with $60.5m invested. This total is $10.9m higher than the previous record year of 2015 when $49.6m was invested. The new record can be attributed to one deal which was responsible for over half of the total capital raised. Israel based anti-fraud platform Riskifed received a $33m investment in a Series C round led by Pitango Venture Capital.

In H1 2017 ten deals were recorded, two less than the total number of investments in the whole of 2016. Thus 2017 looks set to be a record year for deal activity.

Investments in deals over $25m have increased from zero in 2012 to 20% of the totalling H1 2017

Investments in deals worth over $25m now make up 20% of total deals in H1 2017, marking the first-time investments over $25m have been made. In 2012 all deals were less than $1m, but this deal interval now occupies only 40% share of all RegTech deals in the region.

Due to the small sample size the distribution of deals by size varies a lot each year. However, deals of value under $1m and between $5 and $10m are the only transactions that have been present in each year since 2014. This is due to companies which previously raised early-stage funding coming back for more capital.

Onboarding Verification companies are attracting most attention in Rest of World

The relatively small sample size of investments each year in Rest of World countries inevitably results in lots of variation in subsector shares across the period from 2012 to H1 2017.

The most recent deals show that transaction monitoring and onboarding verification are the subsectors attracting the most interest from investors at present, but companies in all other subsectors, except cybersecurity/information security, are successfully raising capital. The absence of cybersecurity deals since 2016 is regarded as a temporary decline as the subsector is amongst the fastest growing in North America and Europe.

The two largest RegTech companies in Rest of World raised over $107m between them

Riskified and VATBox account for $107.7m of the total capital invested in Rest of World RegTech companies, almost double the amount raised by the other eight companies in the top ten, combined. These remaining companies have raised a combined $78.4m. Six of the top ten deals involve companies based in Israel, with the remaining four companies coming from Australia and India.

Of the top ten deals, the largest sub-category to receive funding was transaction monitoring, with three of the deals in these services. The remaining deals were spread over businesses operating within onboarding verification, information security and compliance management.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst