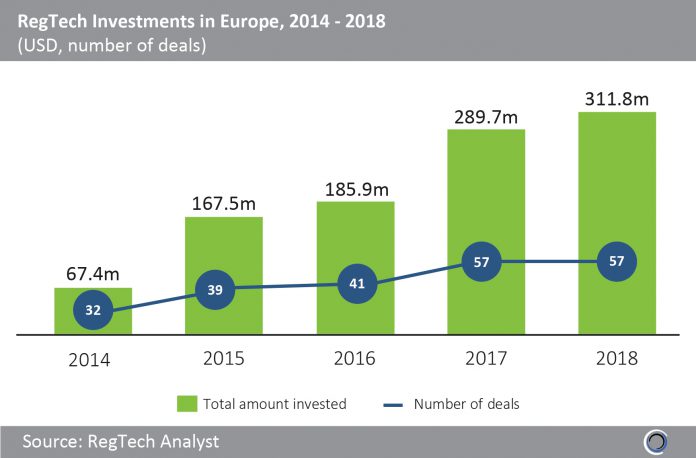

European RegTech investment increased more than 4.6x between 2014 and 2018, with the number of deals nearly doubling during the period.

$67.4m was invested across 32 deals in 2014, with funding increasing by 2.5x to $167.5m the following year. London-based DueDil, which provides access to information on private companies, raised a $17m Series B round, from Oak Investment Partners, Notion Capital, Passion Capital and Playfair Capital, which was the largest deal in 2014.

The amount of capital invested in European RegTech companies reached $289.7m in 2017, with the funding spread across 57 transactions. This increased investment, was 55.8% higher than funding in 2016. This was primarily driven by the $75m Series D round that Darktrace raised from Insight Venture Partners, KKR, TenElen Ventures and Summit Partners.

RegTech investment in Europe hit a record $311.8m in 2018, across 42 deals, which is 88.2% of the total capital raised in 2015 and 2016 combined. VALID, a Swiss digital identity and personal data management platform, raised $10.7m in Q1 2018 which was the only RegTech ICO of the year.

Egress, a London-based provider of compliance and privacy management software, raised a $40m Series C round from FTV Capital and AlbionVC. This was the largest RegTech deal in Europe in Q4 2018, and Egress now has five million users across 2,000 enterprise and government clients.

Copyright © 2018 RegTech Analyst