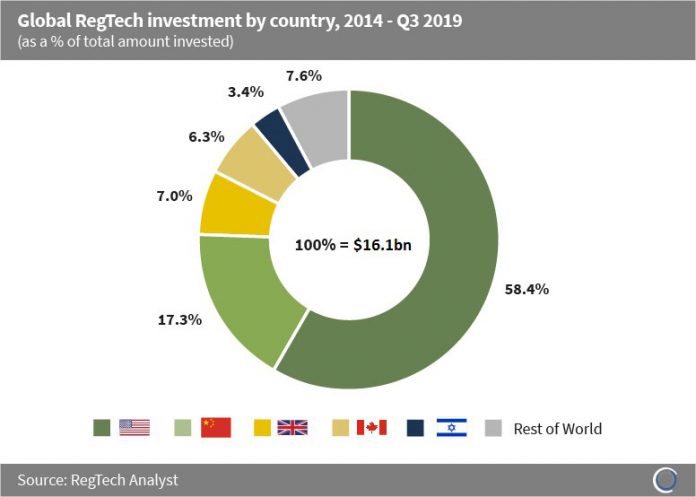

Investors poured $16.1bn into RegTech companies globally between 2014 and Q3 2019, with companies in the US, China, UK, Canada and Israel capturing 92.4% of the capital invested during the period.

The US, as a world leader in capital markets and regulatory compliance, has dominated the RegTech investment landscape, with $9.4bn invested in RegTech companies in the country between 2014 and Q3 2019.

Cybersecurity companies in the US raised over $1.6bn in the first three quarters of the year, which is equal to 38% of the total capital raised by RegTech companies in the US this year, as investors and cyber solution providers front run the potential introduction of GDPR like regulation being implemented in North America.

Companies in Canada, despite only capturing 3.5% of deal activity, raised over $1bn between 2014 and Q3 2019, with two companies; Verafin (fraud detection solution provider) and Element AI involved in two of the largest RegTech deals globally in Q3 2019.

Element AI provides cybersecurity and insurance underwriting risk management solutions, and is headquartered in Montreal. The company raised $150m in a Series B round in September 2019 from investors including McKinsey, valuing the company at $650m.

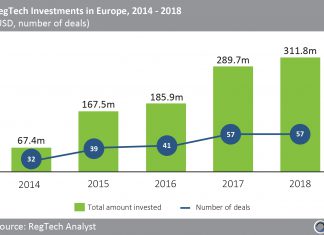

Copyright © 2018 RegTech Analyst