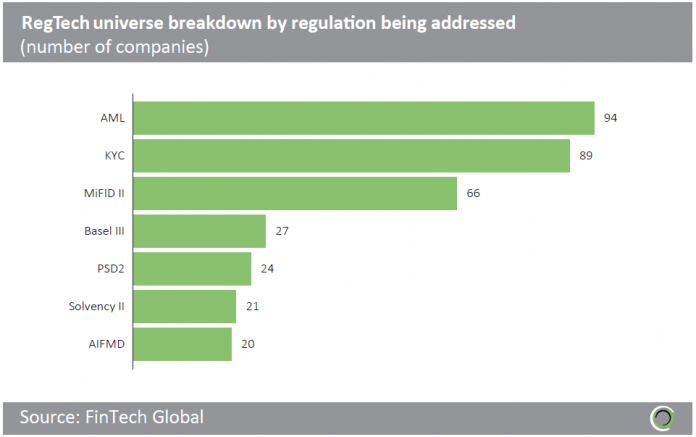

Nearly half of all RegTech companies address AML or KYC regulation

The technology solutions offered by RegTech companies are directly related to regulatory issues or challenges faced by financial institutions.

Given the increasingly complex requirements placed by regulatory authorities on AML and KYC procedures, along with the heavy fines imposed for inadequate compliance, it is no surprise that a majority of RegTech solutions address these particular areas of legislation. Over 100 companies around the world provide offerings that makes compliance with AML and KYC regulation more effective or more efficient.

The third most commonly addressed regulatory framework is MiFID II/MiFIR, which is the EU-wide set of legislation designed to improve transparency and investor protection. It achieves it by, among other things, placing further requirements on entities that trade financial instruments and on investment intermediaries that provide services related to dealing and processing financial instruments.

Solutions addressing Basel III legislation are offered by 27 RegTech companies in order to aid banks with their stress testing and planning, risk management, governance and transparency.

There are 24 companies offering solutions relating to PSD2, the second Payment Services Directive, which requires all payment account providers across the EU to implement the provision of third party access in 2018. In the UK, the requirement of the Competition and Markets Authority (CMA) to facilitate ‘open banking’, within the legal framework defined by PSD2, has elevated the need for investment in the relevant technology to the top of the agenda for both the established high street banks and the new challenger banks.

Over $1.6bn was invested in RegTech solutions that address KYC and AML

An analysis of the capital invested in RegTech companies according to the area of regulation addressed by their solutions reveals which pieces of legislation appear to be causing the most problems within financial institutions and are thereby deemed to offer the most attractive opportunities for investors.

Since 2012, 23.1% of all RegTech investments, which amounts to $878m, can be attributed to investments in KYC solutions. AML follows closely behind with 23.0% of the capital invested and GDPR takes third place with 11.5%.

The next area of legislation to receive the most capital, with 11.4%, is MiFID II/MiFIR. RegTech firms have seen increased interest from investors as the deadline for MiFID II draws closer, with implementation scheduled for January 2018. For example, London-based venture capital firm Illuminate Financial Management invested an undisclosed amount into RegTech company FeedStock in March this year, citing MiFID II/MiFIR regulation as a main factor. Basel III, PSD2,Solvency II and AIFMD combined take up a 17.3% share of the total, with ‘other’ legislations accounting for the remaining 13.7%.

Copyright © 2017 RegTech Analyst

Copyright © 2018 RegTech Analyst