Mobile current account Monese has secured $60m in its Series B which will support its international expansion.

Kinnevik led the investment round, with participation from PayPal, International Airlines Group, Augmentum and existing backers of the company. Augmentum FinTech supplied £5.3m ($6.8m) of capital to the series.

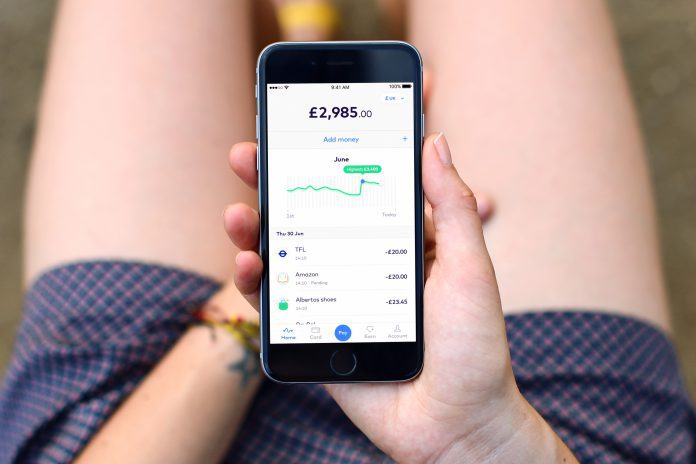

UK-based Monese is a mobile-only curreny account which enables consumers to open European IBAN accounts in 20 countries. Services include, account management, budgeting tools, payments and bank transfers, and cash withdrawals – the company also provides account holders with a contactless payment card.

Its platform is supported by KYC technology which completes global checks in real-time, supporting account creation within minutes, regardless of citizenship, proof of address or credit history.

There are around 600,000 Monese users across the UK and Europe, with its new customers having tripled since the end of last year. Customers now move over $2.5bn each year through Monese accounts, the company said.

Monese hopes to use the capital for product development and support its international expansion.

Monese founder and CEO Norris Koppel said, ““We are excited about this significant investment from world-class investors, which will enable us to continue on our path to becoming a global financial platform to all, offering more people access to the latest generation of mobile banking services.”

The new line of equity brings the company’s total funding to $76m. Its Series A closed on $10m early last year, following commitments from Anthemis, STE Capital, Korea Investment Partners, Seedcamp and SmartCap.

Over the coming months, the company is looking to launch a range of new features and is hoping to hire an additional 100 staff members by the end of the year. Positions will be made in it UK and Estonian offices, and a new office to be opened in Portugal.

Copyright © 2018 FinTech Global

Copyright © 2018 RegTech Analyst