From: FinTech Global

Klarna’s losses grew sevenfold in the first six months of 2020 and now its ongoing conflict with the Swedish government has taken another turn.

The root of why the two are at loggerheads with each other boils down to a new e-commerce law that was made into law earlier this year.

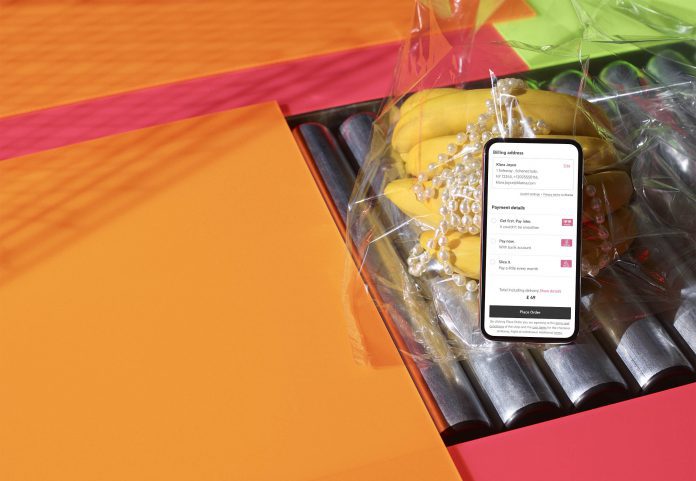

The law, proposed by Sweden’s minister for financial markets Per Bolund, is designed to put an end to having credit as a pre-selected option when buying things online. The aim of law is to prevent consumers from ending up in debt by buying things on credit.

“It’s absurd that the consumer would be pushed into paying with credit for goods or service through e-commerce,” said Bolund in 2019 when proposing the law.

“Research suggests that we are more inclined to opt for whatever pops up first or pre-selected options in regards to different financial alternatives. This proposal prohibits that type of marketing and ensures that consumers take on credit because they chose to and not just because it is pre-selected.”

Despite Klarna and other FinTechs protesting against the law, it has now been enforced. This week Breakit reported that fashion retailer H&M had skirted the law by offering a 30-day invoice via Klarna as the first alternative on its online shop.

H&M argued that it is impossible to separate credit cards and cards that draw money directly from bank accounts these day online.

Klarna has now backed the interpretation of the law.

“One definition of the law that we and many others told the lawmakers about a while ago is that it is not technically possible to separate credit and debit cards,” Joakim Lundberg, general manager Sweden at Klarna, told Breakit.

Copyright © 2018 RegTech Analyst