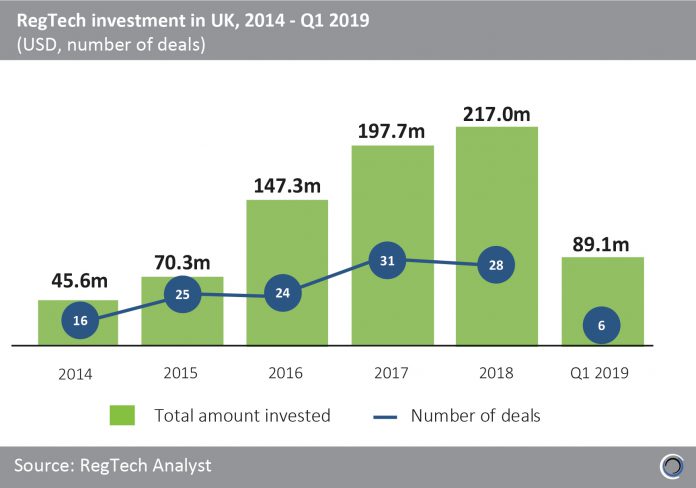

RegTech companies in the UK raised $767m between 2014 and Q1 2019, with investors completing 130 transactions during the period, as the country asserts itself as the dominant center for RegTech in Europe.

More than half of the total RegTech deals in Europe since the start of Q3 2016 have involved companies based in the UK, with investor appetite for deals in the country remaining relatively unaffected by the Brexit decision in June 2016.

Investment increased at a CAGR of 47.7% between 2014 and 2018, with average UK RegTech deal sizes growing from $2.8m to $7.8m during the same period.

Despite slightly lower deal activity than in the previous year, UK RegTech funding hit a record with $217m invested across 28 deals that year. This figure was boosted partly by the $40m Series C funding that London-based Egress, a compliance and privacy management solution provider, raised from FTV Capital and AlbionVC In Q4.

UK RegTech investment in Q1 2019 reached almost $90m, 41% of the total capital raised in 2018, setting strong expectations for the rest of the year. Tessian, an email security solution provider, raised a $41.8m Series B round in January 2019 to accelerate its expansion in the US and other global markets, as well as to invest in research and development to expand its product line this year. This investment, led by Sequoia Capital, was the largest UK RegTech deal last quarter.

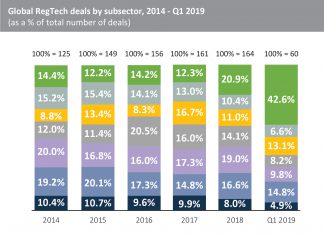

RegTech Analyst platform subscribers can check the full data behind investment activity in all RegTech subsectors.

Not a subscriber? Contact us today

Copyright © 2018 RegTech Analyst