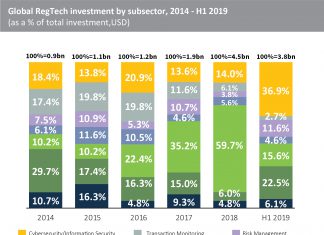

RegTech companies right across the full value chain have raised almost $11bn from investors since 2014, with 16.9% of all RegTech deals during the period involving Cybersecurity companies. Cybersecurity companies within RegTech provide software and technology solutions specifically addressing the challenges of financial regulations such as GDPR and KYC.

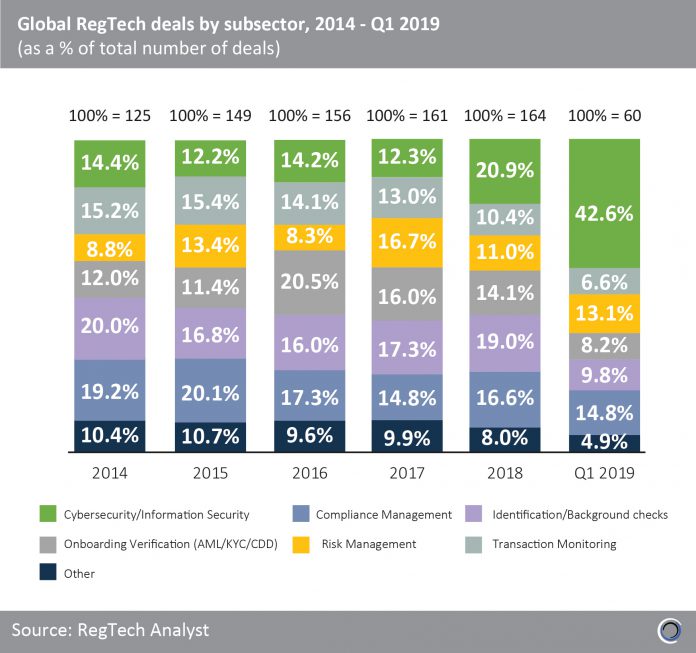

The share of deals involving Cybersecurity companies increased from 14.4% in 2014 to 42.6% last quarter, raising almost $500m in Q1 2019, with 10 cyber deals involving companies based in Silicon Valley and five in Israel.

Illumio, a Silicon Valley-based threat detection and adaptive cloud security solution provider, raised a $65m Series E round in February 2019 which was the largest Cybersecurity deal of the quarter. Investment came from J.P. Morgan Asset Management and will be used for expansion into EMEA.

Risk Management solution providers increased their share of RegTech deal activity from 8.8% in 2014 to 13.1% of transactions in the first three months of 2019. Kyriba develops treasury management software that assists treasury and finance departments with managing FX volatility risk and compliance. The San Diego-based SaaS company raised $160m in growth equity from Bridgepoint in March 2019, pushing the company’s valuation to $1.2bn in what was the largest Risk management deal of Q1.

The share of deal activity involving companies in other RegTech subsectors, which includes Capital Planning/Stress Testing, Reporting and Communications Monitoring, had been stable between 2014 and 2018, dipping only slightly from 10.4% to 8.0% during the period, but dropped further to 4.9% of deals in Q1 2019.

Copyright © 2018 RegTech Analyst