Europe has been the second most important region in the world, after North America, for RegTech deal activity and investment since 2014.

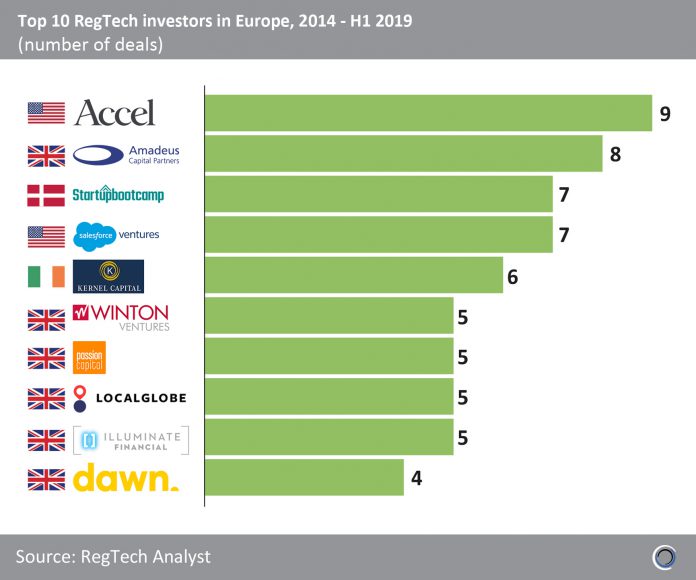

The UK has dominated RegTech investment across Europe over the past five and a half years, which is reflected in the breakdown of top investors by country of origin, with six UK-based RegTech investors making it onto the top ten.

US-based venture capital firm Accel has been the most active RegTech investor in Europe, completing nine transactions between 2014 and H1 2019. The organization has also raised over $12bn since its founding in 1983. Accel participated in the $60m Series C round raised by Shift Technology, an insurance fraud detection solution provider based in Paris, in Q1 2019. This is the second largest RegTech deal in France to date and Accel’s largest RegTech deal in Europe.

Amadeus Capital Partners is a private equity and venture capital firm based in Cambridge, UK, with a focus on the technology sector. The company has backed more than 130 companies and has raised over $1bn since its founding in 1997. It is the most active UK-based RegTech investor in Europe having completed eight transactions since 2014. The firm most recently led a $2m Seed round in The ID Co, a customer onboarding solution provider based in Edinburgh, in May 2019.

Copyright © 2018 RegTech Analyst