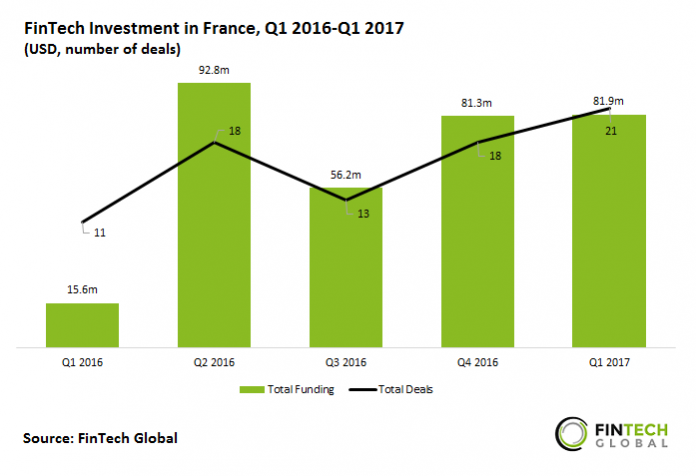

Q1 2017 shows French FinTech rise with nearly double the total deals and funding rising over 5-fold compared with Q1 2016

The FinTech sector in France is booming. Funding for FinTech-focused companies has grown rapidly over the last few years, with 2016 being a record year for investments. The last quarter was one of the strongest French FinTech has ever seen for investment activity, as the growth trend continued into Q1 2017.

- Q1 2017 was a record quarter for French FinTech as it was the most active quarter for deals ever.

- Q1 2017’s total funding was over 4 times larger than Q1 2016’s, and total deals nearly doubled.

- Q2 2016 was FinTech’s most heavy in terms of investment total over the last 5 quarters with $92.8m.

France’s FinTech space sees record level for both funding and total deals in 2016

- The last 3 years’ worth of funding figures have seen a big upturn YoY. 2016 saw total funding reach $246.0m – a record for a year in French FinTech.

- The total deals and total funding for Q1 2017 exceeds the same total from 2014 on both cases. Q1 2017’s total deals are already over a third of 2016’s total and nearly a third of 2016’s total funding.

- Total deals and total funding grew at a CAGR of 46.1% and 64.4%, respectively.

- BPIFrance (6) and Aurinvest (3) were the most active investors in the 5-year period of 2012-2016. No other investor invested more than twice into French FinTech during the period.

- Orange Digital Ventures ($53.5m) and serial investor BPIFrance ($39.1m) top the list of investors who participated in the highest total funding rounds in 2012-2016.

Funding sees more diversity in 2016 compared with prior years as Marketplace Lending-focused funding drops YoY

- For 2014-2016, French FinTech funding has seen over two-thirds of funding go to just 3 sub sectors.

- The funding to other sectors is rising YoY, with 2016 seeing over a quarter of funding go to sectors outside of the main 3 for the first time in the period.

- Marketplace Lending has seen its share of funding reduce by 23.2% in 2014-2016, even though funding for the sector more than double over the period. This was due to all other sectors also making gains in funding as the industry expands.

Payments & Remittances lead the way in French FinTech with over a fifth of the company share

- Over half (52.4%) of French FinTech is comprised of firms focused on either Payments & Remittances, WealthTech, or Infrastructure & Enterprise Software.

- Marketplace Lending holds only 8.3% of the overall company share. Although it has received 35.4% of the total funding in French FinTech since 2007.

- The largest funding round in Payments & Remittances was for omnichannel management platform for E-Commerce firm Wynd, who in late 2016 received $31.7m in a Series B round from Orange Digital Ventures, Sodexo Ventures, and serial French FinTech funder BPIFrance.

The rapid expansion of French FinTech since 2014, coupled with 2017’s strong start in terms of both total funding and total deals, shows France’s FinTech space to be in a strong place.

Copyright © 2018 RegTech Analyst