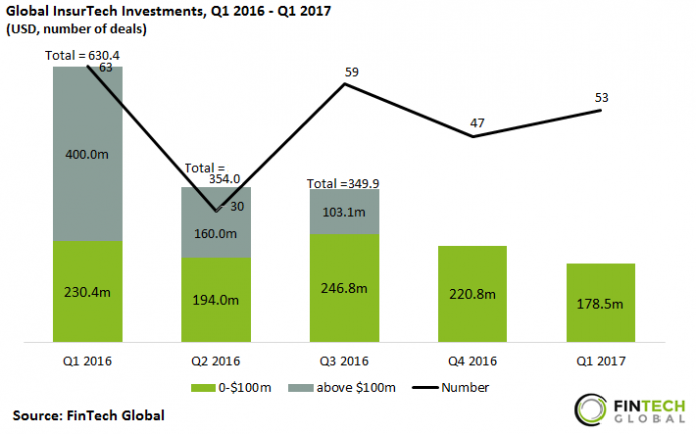

InsurTech companies are developing technological solutions to revolutionise the insurance industry. Companies such as RiskGenius are working to create more efficient underwriting workflows while other InsurTech companies such as Lemonade and Cuvva focus on offering instant, highly customisable insurance policies. Although the potential of this technology has created a lot of interest in the sector this has not resulted in an increase in increasing funding over the last 5 quarters.

Investments in InsurTech have fallen worldwide in the last 5 quarters

- Q1 2017 saw the total invested in InsurTech fall to a 5-quarter low, with investments under $100m falling by 22.5% yoy.

- For the second quarter in a row the InsurTech sector has failed to close a deal above $100m with the largest deal in Q1 2017 going to Singapore based CXA Group.

- Whilst not reaching levels in Q1 2016 the number of deals has remained stable in Q1 2017, with 6 more deals closed in the quarter than in Q4 2016.

- The percentage of deals valued below $1m rose yoy from 25% in Q1 2016 to 30% in Q1 2017.

The percentage of deals closed in the United States has been falling since 2014, with Q1 2017 enforcing this trend.

- Europe closed the largest percentage of InsurTech deals in Q1 2017, despite only taking a 22.6% share in 2016. Q1 2017 saw Europe close 22 deals in InsurTech. This is almost half the number of European InsurTech deals closed in the whole of 2016.

- The share of InsurTech deals in North America has been progressively decreasing since 2014. Q1 2017 also saw the overall amount invested in American InsurTech fall below the investment in European InsurTech for the first time. With $89.9m invested in Europe and only $72.2m invested in North America.

- Other regions saw a jump in their share of investments in Q1 2017, receiving 15.1% of investments. This includes countries such as South Africa, Israel and Australia. There were 2 InsurTech deals passed in Israeli in this quarter. One of these was received by Getmelns who won a $1m investment from Jerusalem Venture Partners in the first InsurTech Israel competition.

Three of the top 5 InsurTech deals worldwide in Q1 2017 went to companies based in Europe

- CAX group received the largest InsurTech deal in Q1 2017, raising $25m in their Series B round in February. Based in Singapore the company runs a corporate benefits aggregator for insurance, healthcare and wellness.

- UK-based CompareEuropeGroup picked up the largest funding round in Europe, securing €20m for its insurance comparison platform.

- Two of the top five InsurTech deals went to companies based in Germany. Berlin based Simplesurance develops cross-selling solutions to change the way people buy insurance and Ottonava Holdings develops better private health insurance from their headquarters in Munich.

500 Startups was the most active investor in InsurTech in the last 5 quarters.

- 500 Startups made the most investments in InsurTech over the last 5 quarters. The firm have invested in InsurTech companies; BenRevo, Cyberwrite and Regard through their 500 Accelerator. These company’s make-up three of the forty-four companies to graduate from the 500 Accelerator in February.

- Eight of the top ten investors are based in the United States with the other two; Protechting and InsurTech.vc based in Portugal and Germany respectively.

Despite the decline in funding over the last 5 quarters there may be a light at the end of the tunnel for InsurTech. So far in Q2 2017 Singapore life has closed the larges deal in Asian InsurTech to date with a $50m Series A funding round from Impact Capital and UK- based IPGL.

Copyright © 2018 RegTech Analyst