China and Australia’s regulators have agreed a partnership to share information on FinTech developments and RegTech insights.

In a move to promote innovation in financial services in their respective markets, the Australian Securities and Investment Commission (ASIC) and China Securities Regulatory Commission (CSRC) have signed an agreement.

The agreement will provide a framework for information sharing, with the two regulators sharing emerging market trends and developments, as well as regulatory developments

It will also enable CSRC and ASIC to collaborate through sharing information on RegTech trials.

In addition to the “ample opportunities” arising from the partnership, CSRC chairman Shiyu Liu said financial market regulators around the globe are facing requirements and challenges posed by market innovations

ASIC chairman Greg Medcraft added, ‘Co-operation between regulators is essential to realise the benefits of the technological revolution. Understanding new developments and their impact in overseas markets helps us to remain proactive and forward-looking in our domestic approach. This Agreement represents an exciting opportunity for us to learn more about the Chinese fintech sector, which is renowned for its success and dynamism. We also look forward to sharing our insights and experiences on RegTech with the CSRC.’

ASIC previously entered into similar agreements with Hong Kong, Indonesia, Japan, Kenya, Malaysia, Ontario, Singapore, Switzerland, the United Kingdom, and the UAE.

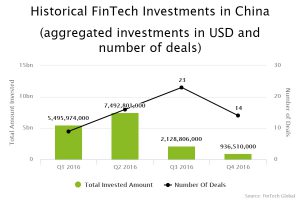

Last year, the Chinese FinTech industry saw more than $16bn invested across 62 deals according to data by FinTech Global.

Copyright © 2017 FINTECH GLOBAL

Copyright © 2018 RegTech Analyst