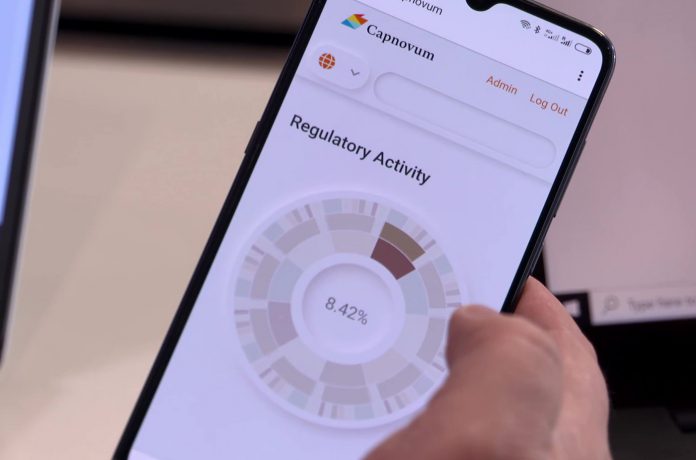

Capnovum’s solution slashes the time needed to keep up with regulations from weeks to minutes. The startup is now ambitiously accelerating the growth of its industry agnostic platform.

Niclas Nilsson is extremely busy. “I’m good, but I’m not sleeping anymore,” he laughs. However, he’s not joking. These days the Capnovum founder and CEO splits his time between running the venture, sharing insights at events across the world, leading a top notch leadership team and navigating a global pandemic. Although, Nilsson is used to high-pressure situations.

Since launching Capnovum in 2014, he’s experienced several. At the time, he’d spent about two decades clocking up experience in the financial market after his graduation from Lund University with a masters degree in business and economics in 1998. “I’ve been in the financial services industry for most of my life,” Nilsson says.

Over the years he had developed businesses in internal roles and as a financial services consultant. It was during his last stint as a consultant that he realised a way these institutions could yield massive wins.

Simply put, many businesses often have to restart on square one whenever a new regulatory project kicks off. Usually, that’s because they haven’t been able to learn

from the lessons of their last similar project. Moreover, they were often extremely time-consuming. But there was a solution. “Pretty much everything we did could be done faster, better, cheaper by a computer,” Nilsson recalls.

He knew artificial intelligence could ensure project efficiency improvements and boost knowledge retention between projects. Doing so could give businesses increased efficiency and save a lot of money. Recognising the opportunity, Nilsson contacted some of the professionals he’d been working with over the years to launch what would become Capnovum.

Next, they reached out to financial institutions to test the startup’s concept. After consulting with these companies, the Capnovum team realised that it could have the biggest impact on the compliance segment of the market. Fuelled by this insight, the venture set out to create the first version of its platform.

The team was soon able to field-test the platform. The tests spanned across Europe. During these trials, the team noticed how clients were immensely interested in tapping into Capnovum’s data feed. “So we started to build the platform, focusing primarily on the API and built the front end with the left hand,” Nilsson remembers. “In retrospect, we now know that that was a mistake.”

It turned out that the application programming interface wasn’t used as often as they thought it would be. Consequently, the Capnovum team has since focused more on the user interface and usability than on API services.

Like many startups, Capnovum experienced early changes in the core team. These changes provided an opportunity to take stock of the team’s ideas and where they wanted to go next. Realising that they had a lot left to give, Nilsson reached out to a former colleague who specialised in database applications to help him build a new version of the platform.

Nilsson also had another task in mind: to help him get back into programming. Nilsson had previously studied it back in the 1990s. “At that point I hadn’t been programming professionally for 15, 20 years,” he says. While reawakening his dormant coding skills, Nilsson and his friend managed to get a workable solution up and running within six weeks. It was a product Nilsson could happily demonstrate to new clients as a solid step forward.

However, he wasn’t done yet. “By that time I’d gotten up to speed on my coding, I just thought I’m gonna have to start again from scratch because the technology we were using wasn’t scalable to the extent that we needed,” Nilsson says. “So after those meetings, I locked myself in a room for about 15 months and built the entire first release of the platform myself.” That included programming the data capture, the AI, the database, the APIs and the front end. The result was the solution that Capnovum is centred around today.

The new platform was released in 2016, but Nilsson believes the market wasn’t ready for it at that stage. “After 2008, compliance had risen in importance in organisations,” he explains. “They had huge budgets. Cost cutting wasn’t necessarily their immediate focus. And we were probably seen more as focused on cost- cutting than anything else.”

That didn’t stop the Capnovum team. It spent the next few years showcasing the usefulness of the solution, speaking at conferences and reaching out to stakeholders in the industry. These years involved a lot of hard work, but also yielded impressive results.

For starters, the company has been cash positive since 2016. In September 2017, Capnovum was picked to be part of the Supercharger accelerator’s Kuala Lumpur programme. The startup was elected for the Momentum London accelerator in 2018 and in 2019 Capnovum participated in PwC’s inaugural LawTech Scale Up programme.

“We’ve gone through very good accelerators,” Nilsson says. “Each of the three were high quality. And it’s given us a really good network in the startup environment.” This new startup network coupled with the core team’s experience within financial services was one of the reasons why the company has enjoyed impressive growth in the past three years. It has also enabled Capnovum to bag a spot on RegTech Analyst’s coveted RegTech100 list of the 100 most innovative RegTech company’s in the world four times in a row.

Another reason why the venture enjoyed so many successes was that Capnovum started to really pitch the use of AI in its marketing, even though it had been part of the solution from the get-go. “We hadn’t told anybody about that because it was just a way of doing things,” Nilsson states. “[That was the case] up until 2017 or so when people started marketing AI, and everybody had AI everywhere.” That’s how it turned out that the thing that they had always done proved to be a very useful selling point.

This year Covid-19 has accelerated Capnovum’s growth further. While recognising that the pandemic has caused a lot of suffering, the Capnovum team suggests that it has also created more opportunities. “The market is changing,” says Inga Jovanovic, chief marketing officer at Capnovum. “We see more and more automation, more and more artificial intelligence, more and more people working from home, more and more companies looking at really getting rid of manual workflows.”

Capnovum grew its staff by almost 50% in the first half year of the pandemic, including the RegTech company strengthening its leadership team.”I’ve had a wish list of people I would like to have on board and now, thanks to Covid-19 making them more open to new opportunities, I have several of them on board,” Nilsson says. “So we’re switching gears big time. I have managed to recruit a very experienced management team.”

The new talent has strengthened the further expansion of Capnovum, all under the watchful eyes of the leadership, including the very hands-on chairman of Capnovum’s advisory board Jaap Remijn.

But more is still to come. Up until now, Capnovum has enjoyed tremendous growth and successes without outside investment. “I’m gonna be honest with you and say that that was a mistake,” admits Derek Forder, chief strategy officer at Capnovum. “It would have been better for us to go through a funding round earlier. While we are by no means desperate for investment, we do offer a great opportunity for smart money that can help us scale commercially across geographies and industries.”

In fact, Capnovum is now looking to scale on the commercial side with by raising its first funding round. “We are going to raise in the not too distant future,” says Forder, adding that the company is raising from a position of strength, having been cash positive for four years and having an established the platform. “So we’re in a reasonably good position there, but of course it would have been much easier if we had already gone through it,” he says.

In the meantime, the company is staying busy. For instance, Capnovum is about to move beyond its financial services roots. “Today we cover banking, capital markets, insurance and pensions, but we’re now going into other industries,” Nilsson says. The first new industry the company is expanding into is life sciences, and there are already more additional industries to the platform in the pipeline. “We are ready to shift gears,” Nilsson concludes.

Copyright © 2018 RegTech Analyst