From: FinTech Global

German challenger bank N26 is going to cancel its UK operations, blaming the Brexit regulatory uncertainty for the decision. Now, a Dutch competitor is making fun of it.

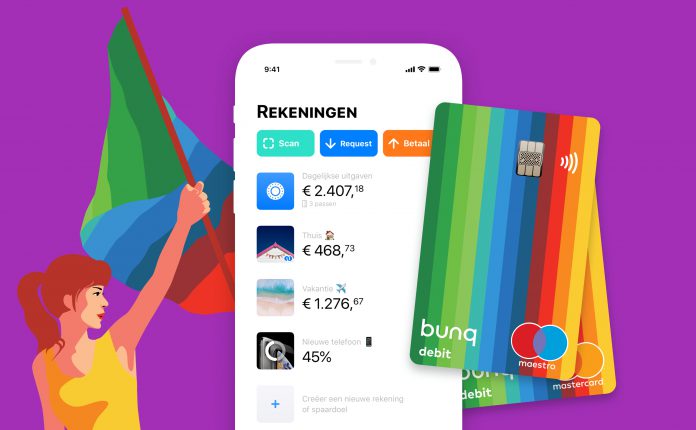

The news about the German FinTech firm’s decision to pull out rocked the UK industry earlier this week. However, Ali Niknam, founder and CEO of bunq, has taken a slightly more jokey approach to the rival’s British exodus.

“You might have heard one of our FinTech peers is leaving the UK,” he wrote in a statement. “Fear not: bunq is here to stay. Based on the current rules and regulations, we see no (regulatory) reason to leave the UK. In fact, we love you guys! Let’s bunq together.”

N26 had blamed the uncertainties caused by the UK’s divorce from the EU for it cancelling all its services in April and advised its customers to transfer their money to another lender before the deadline.

“With the UK having left the EU at the end of January, we will in due course no longer be able to operate in the UK with our European banking licence,” the bank wrote in a statement. “Therefore we will be leaving the UK and closing all accounts in the coming months. We’ve planned the next steps carefully to ensure this process is as smooth as possible.”

Copyright © 2018 RegTech Analyst