Pagaya, an asset management support solution powered by machine learning, has closed its Series B round on $14m.

Oak HC/FT and former American Express chairman and CEO Harvey Golub took part in the series, which also picked up commitments from a number of unnamed investors.

As part of the transaction, Oak HC/FT venture partner Dn Petrozzo will join the company’s board of directors.

Israel-based Pagaya uses machine learning algorithms to and big data analytics to support the asset management markets. The robo-advisory service improves risk management, scalable results, and is focused on short duration, high-yield investment strategies.

Earlier in the year, Pagaya picked up $75m in a debt financing deal with Citi.

Other investors into the company include GF Investments, Siam Commercial Bank, Clal Insurance, and Viola Group.

Oak HC/FT recently led the $30m Series B round of Groundspeed Analytics, an AI and data science solution for the insurance sector. The company uses AI and machine learning technology to provide insurance companies with the ability to automatically transform loss runs.

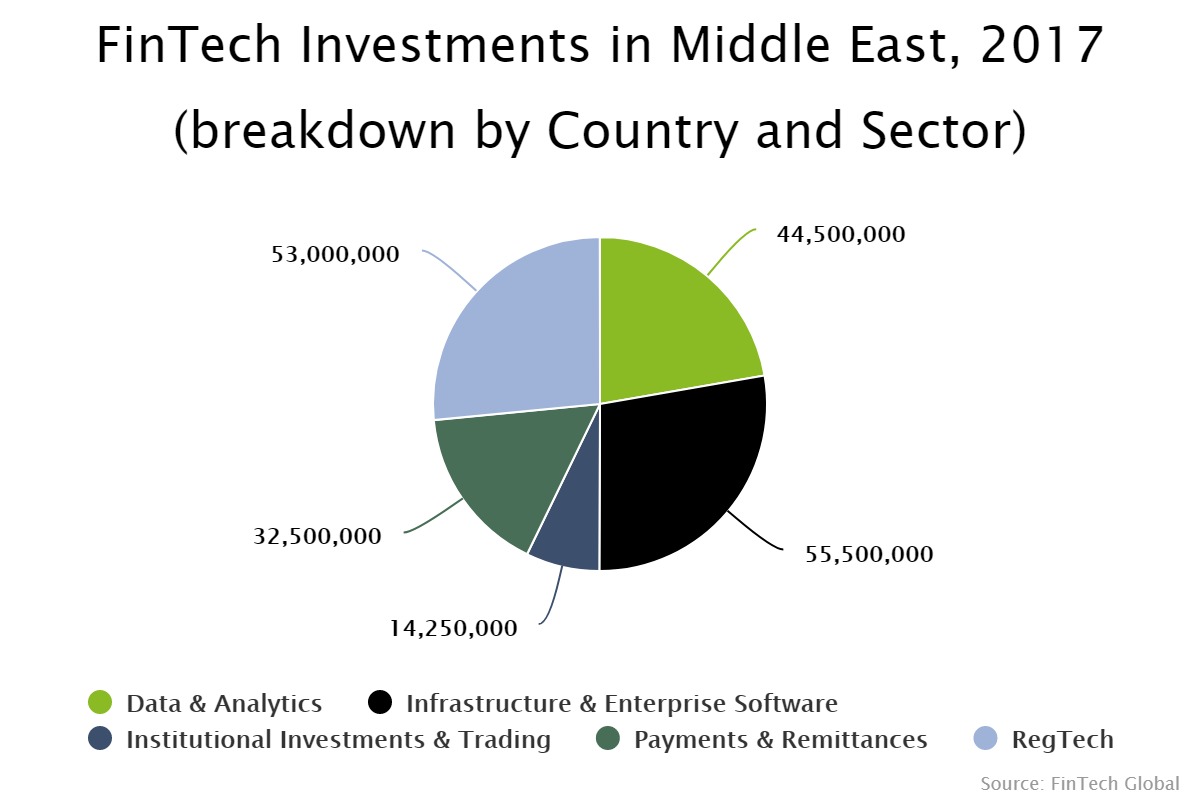

Last year, the biggest space for funding in Israel’s FinTech space was the infrastructure and enterprise software. According to data by FinTech Global, the country received a total of $199m, of which infrastructure and enterprise companies received 28 per cent of the capital.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst