Key RegTech investment stats in Q3 2024:

- Global RegTech deal activity increased by 20% QoQ

- Average deal value dropped to $12m as investors back smaller deals

- Protect AI, a Seattle-based artificial intelligence (AI) and machine learning (ML) security company, secured one of the largest US RegTech deals for the quarter with a Series B funding round of $60m

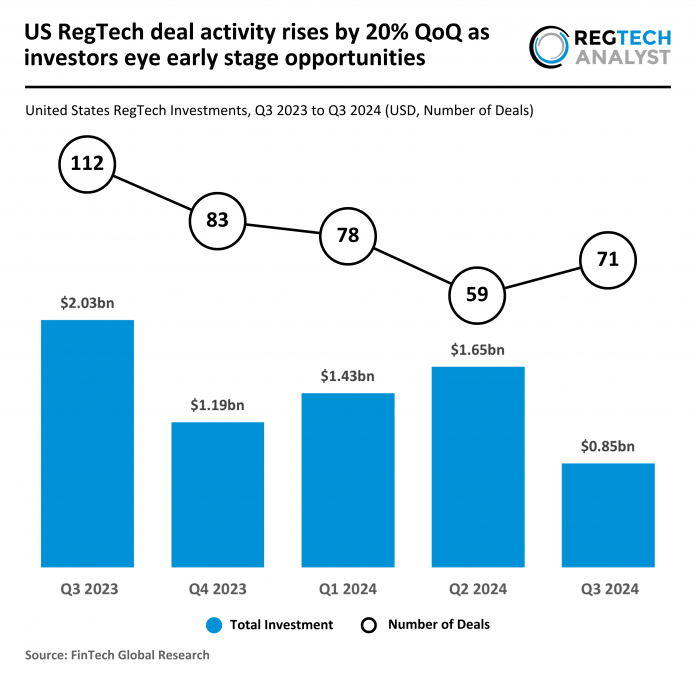

In Q3 2024, the US RegTech sector experienced substantial declines in both deal activity and funding compared to the same quarter last year.

Only 71 deals were recorded in Q3 2024, representing a 37% decrease from the 112 funding rounds completed in Q3 2023.

Funding fell even more sharply, with RegTech firms raising just $855m in Q3 2024—a 58% drop from the $2bn raised in Q3 2023.

These figures highlight a challenging investment climate for the sector, with investors significantly scaling back their funding allocations year-over-year.

When comparing Q2 to Q3 2024, deal activity increased modestly as the number of transactions rose from 59 to 71, marking a 20% QoQ increase.

However, total funding dropped by 48% from $1.6bn in Q2 to $855m in Q3.

This divergence indicates that while deal volume improved, the average deal size shrank considerably, reflecting investor caution and a focus on early stage investments.

The average deal value in Q3 2024 was $12m, a sharp decline from the $27.9m average in Q2 2024 and significantly lower than the $18.2m average deal value in Q3 2023.

This shift towards smaller deals suggests a more conservative approach by investors, likely influenced by heightened economic uncertainties and regulatory pressures.

Projections indicate that deal activity for 2024 would reach 252 deals, marking a 39% decline from the 413 deals completed in 2023, while total funding is on track to reach $4.6bn, a 34% decrease from the $7bn raised last year.

Protect AI, a Seattle-based artificial intelligence (AI) and machine learning (ML) security company, has secured one of the largest RegTech deals in the US for the quarter with a $60m Series B funding round, led by Evolution Equity Partners and supported by 01 Advisors, StepStone Group, Samsung, and existing investors such as Acrew Capital and Salesforce Ventures.

This investment brings the company’s total funding to $108.5m and will be used to enhance its AI security posture management platform, advance research and development, expand customer success and sales efforts, and strengthen channel programmes.

Founded by former AWS and Oracle AI executives, Protect AI provides an end-to-end security solution utilised by public and private sector clients to safeguard traditional ML models, large language models (LLMs), ML systems, and AI applications.

With a track record of four acquisitions, the company plans to add 50 employees by the end of 2024, furthering its 300% team growth achieved year-over-year.

Keep up with all the latest RegTech news here

Copyright © 2024 RegTech Analyst

Copyright © 2018 RegTech Analyst