Cerebro Capital, an online platform supporting corporates with credit facilities, has bagged a Series A from Sterling Partners and the state of Maryland’s TEDCO fund.

Maryland-based Cerebro is an online platform that enables middle market borrowers and corporate lenders to analyse, manage and source credit facilities. Through its data solution users can discover market trends, anonymously search lenders, determine the viability of financing their deals, and remove existing deal pain points.

Clients can also implement the platform for the automation of loan compliance, ensuring easy tracking of loan agreements and lender covenant report generation.

Since it launched in October last year, the company has sourced and managed more than $1bn in loans through the platform.

With this fresh burst of capital, Cerebro hopes to scale its online marketplace, increase its capacity for debt transactions and building its sales, marketing and engineering teams.

Sterling Partners co-founder Doug Becker said, “Cerebro gives middle market borrowers financial self-awareness that previously had only been available to public companies. Cerebro takes it a step further by giving their borrower users the ability to connect to the lender network that is providing the data. The value created for both borrowers and lenders made this a natural decision for Sterling to become involved.”

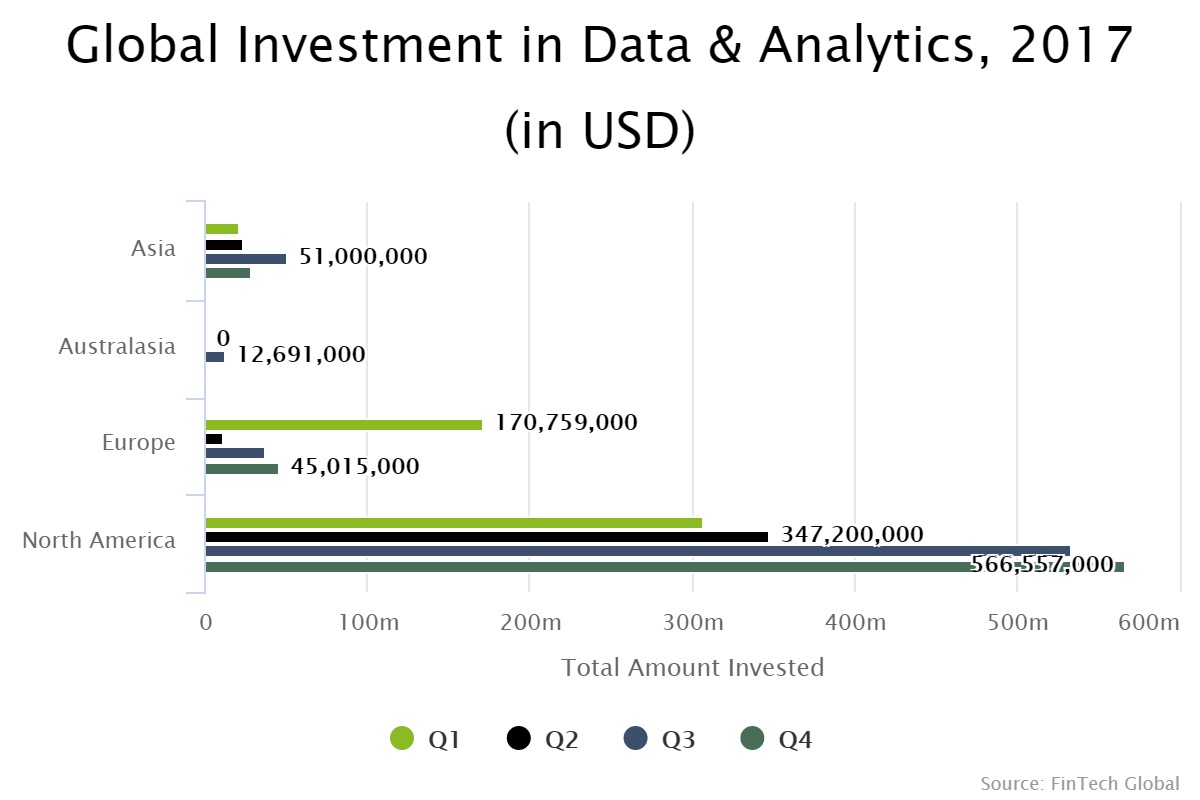

The data and analytics sector was dominated by the North American market, last year, according to data by FinTech Global. Of the $2.1bn that was invested globally, around 81 per cent was deployed to companies in North America.

Copyright © 2018 RegTech Analyst