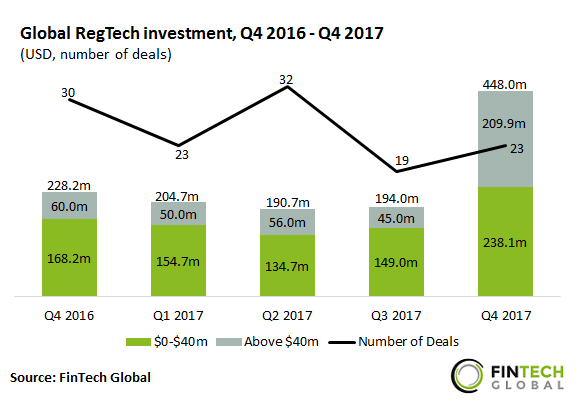

With nearly $0.5bn, the last quarter of 2017 accounted for 43.2% of the total amount invested in the whole year

- The RegTech industry saw $448m invested in Q4 2017 – more than double the value of the previous quarter, making it the strongest funding quarter to date.

- This surge is partially due to a rise in the funding raised from deals valued above $40m which increased by 4.7x. Additionally, funding raised from sub-$40m deals increased by 1.6x.

- The largest RegTech deal of Q4 2017 went to MetricStream, a provider of cloud-based solutions for governance, risk and compliance. The company raised $65m in a venture round led by Clearlake Capital Group with co-investment from Goldman Sachs, Sageview Capital and EDBI.

- Despite the surge in total amount invested, deal activity in Q4 2017 remained well within range of historic levels at 23 deals, 7 less than in the same quarter last year.

Global RegTech investments reached a new high in 2017, surpassing $1bn-worth of funding

- The total amount invested in RegTech companies globally increased steadily at a CAGR of 10.8% between 2014 and 2017 to reach a total of $1.04bn.

- As the RegTech industry matures the growth in investments is mainly driven by later-stage deals. Last year funding from deals valued above $40m increased by more than 50% YoY, whilst funding from deals in the $0-40m category remained fairly steady.

- In contrast to this, deal activity dropped in 2017 to reach its lowest value since 2013. Correspondingly, the average deal size increased from $9.8m in 2016 to $13.5m in 2017.

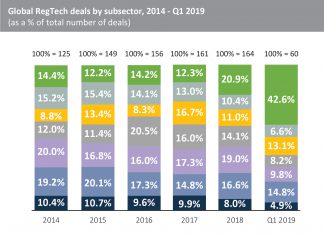

The shift towards larger deals picked up again in 2017, after a pause in 2016

- There was a shift towards larger deals from 2014 to 2015, as demonstrated by the share of sub-$1m deals falling from 40% to 28.4%. This category then remained steady over the next year, before dropping in share again by 15.8% between 2016 and 2017.

- The decrease in share of smaller deals was partially offset by an increase in deals valued above $25m. This category more than doubled its share between 2014 and 2017, increasing from 9.4% to 19.5%.

- Additionally, deals valued between $10-25m increased in share over the four-year period, from 12.9% to 22.1%. Notable deals in this category from 2017 include a $17.5m deal to Simility, a provider of fraud prevention solutions, in a Series B round led by Accel Partners. Additionally, Dome9 Security, a cloud security specialist, raised $16.5m in a Series C round led by Softbank.

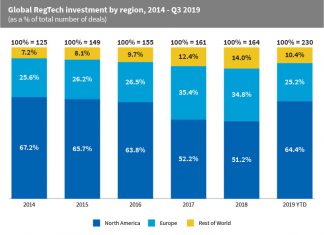

There is increasing geographic diversity in RegTech investments

- In 2014, almost 70% of RegTech deals went to companies based in North America, whilst those in Europe represented a quarter of all deals.

- Over the period of 2014-2017, North America’s share of RegTech deals decreased by 13%. This decrease was partially taken up by deals to Asian RegTech companies, which increased from 1% to 6.2% over the same period. All deals in Asia went to companies based in either Singapore, Hong Kong, China or India.

- Additionally, companies in ‘Other’ regions, including South America, Australasia and Africa, increased in deal share from 1% in 2014 to 7.2% in 2017. This highlights the spreading geographic range of the RegTech industry as it matures.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst