More than 50% of the total capital raised by RegTech companies last year has been invested in 2018 already

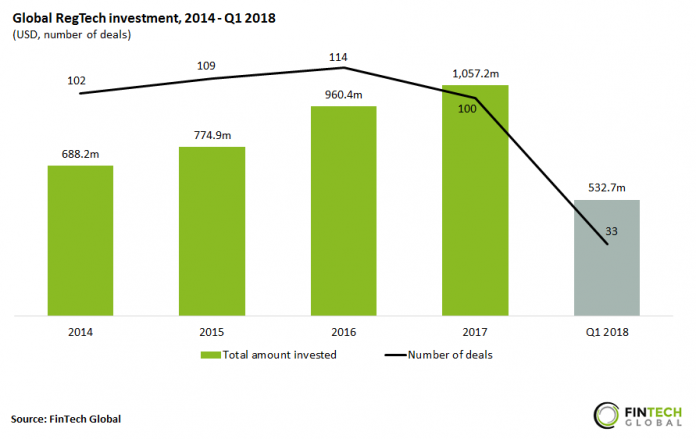

- Global RegTech deal activity grew from 102 deals in 2014 to 114 deals in 2016, with investment growing by 40% over the same period.

- Despite a fall in deal activity to 100 last year, investment jumped by almost $100m. This was driven by an increase in the number of later-stage deals such as the $25m series E funding that Convercent, an ethics and compliance software provider, raised in Q4.

- As the RegTech funding landscape matures and with increased pressure from regulations such as GDPR coming into effect, more investment is expected to flow into the sector.

Global RegTech investment in 2018 started the year strongly, with over $500m raised across 33 deals

- Global RegTech investment doubled between Q1 and Q4 2017, reaching just under $420m at the end of last year. Funding over the past four quarters has been on an upward trajectory reaching $532.7m in Q1 2018, almost three times the amount raised in Q2 2017.

- Nearly 44% of the total capital invested in the RegTech sector in 2017 was raised in Q4, driven by an increase in later-stage deals. Feedzai, a financial fraud risk management provider, raised $50m in series C funding from Sapphire Ventures in one of the largest deals of the year.

- Global RegTech investment in Q1 2018 has already surpassed $500m, setting strong funding expectations for the rest of the year. Sift Science, a payment fraud detection platform, raised $53m in series D funding led by Stripes Group. The investment will be used to fund a global rollout of its fraud detection solutions.

Three of the top 10 global RegTech deals over the past five quarters took place in Q1 2018

- The top 10 global RegTech deals raised $575m between Q1 2017 and Q1 2018, with over 40% of this funding raised in Q1 2018. The landscape for large RegTech deals has been dominated by US companies, with all of the top 10 being headquartered there.

- The largest deal was the $100m series B funding that XebiaLabs, a compliance automation software developer, raised in Q1 2018. This funding was led by Susquehanna Growth Equity and Accel Partners.

- Collibra, a New York-based data governance solutions provider, was quite active in 2017 with two funding rounds listed among the top 10 deals. It raised a $50m series C funding round in Q1, led by ICONIQ Capital and a $58m series D round, led again by ICONIQ Capital with participation from Battery Ventures. Collibra plans to expand aggressively by investing in product engineering and sales and marketing.

Investors turned to the established markets of North America and Europe, retreating from developing countries

- North American companies were involved in over two thirds of all RegTech deals between 2014 and 2016, before dropping below 60% of deals last year. The share of deals involving North American companies rebounded back above two thirds in Q1 2018, setting strong expectations that companies in the region will dominate RegTech deal activity this year.

- Companies in other regions of the world were involved in 6.0% of RegTech deals last year raising $10.4m, just 1% of the total sector investment in 2017. Australian onboarding solutions provider, iSignthis, raised just under $5m of post-IPO equity funding in the largest deal outside of North America, Europe and Asia.

- European companies were involved in almost 30% of all RegTech deals last year and over 30% of deals in Q1 2018, up from 22.8% in 2016. As financial market participants begin to adapt to the new regulatory landscape in Europe and brace themselves for the implementation of new regulations, such as FRTB scheduled for 2019, the continent’s share of RegTech deal activity could increase.

The data for this research was taken from the FinTech Global database. More in-depth data and analytics on investments and companies across all FinTech sectors and regions around the world are available to subscribers of FinTech Global. ©2018 FinTech Global

Copyright © 2018 RegTech Analyst