Australian challenger bank Xinja has picked SAP SE to help power its digital bank mobile service.

The SAP Cloud for Banking platform will provide Xinja with its loans, deposits and payment engine, the cloud platform, and its application management services.

Through the integration, Xinja will be able to simplify product design, quickly respond to regulatory changes, onboard customers instantly, enable open banking capabilities and integrate payment systems and business networks. Alongside this, Xinja will be able to access customer insights and manage risk in real-time, ensuring it remains agile and driven by customer data.

Xinja is an independent digital bank app, which offers Australians the ability for money and banking management. The mobile-based platform helps consumers to track spending, and improve savings. Through the solution, users are able to save money or pay a bill with a single button, set up an account without paperwork and receive 24/7 support.

The bank is currently in the process of attaining a restricted banking licence from the Australian Prudential Regulation Authority.

Xinja founder and CEO Eric Wilson said, “Xinja is incredibly excited about this partnership with SAP. It means that right now we have a world class technology platform that will allow us to develop fantastic products for our customers into the future, as we work alongside a global company with a wealth of experience in the financial services sector.”

Earlier in the year, the bank closed a crowd funding campaign on AUS $2.4m ($1.7m) which was raised through the Equitise platform. The company reached the initial AUD $500,000 target was raised within just four days of the sale.

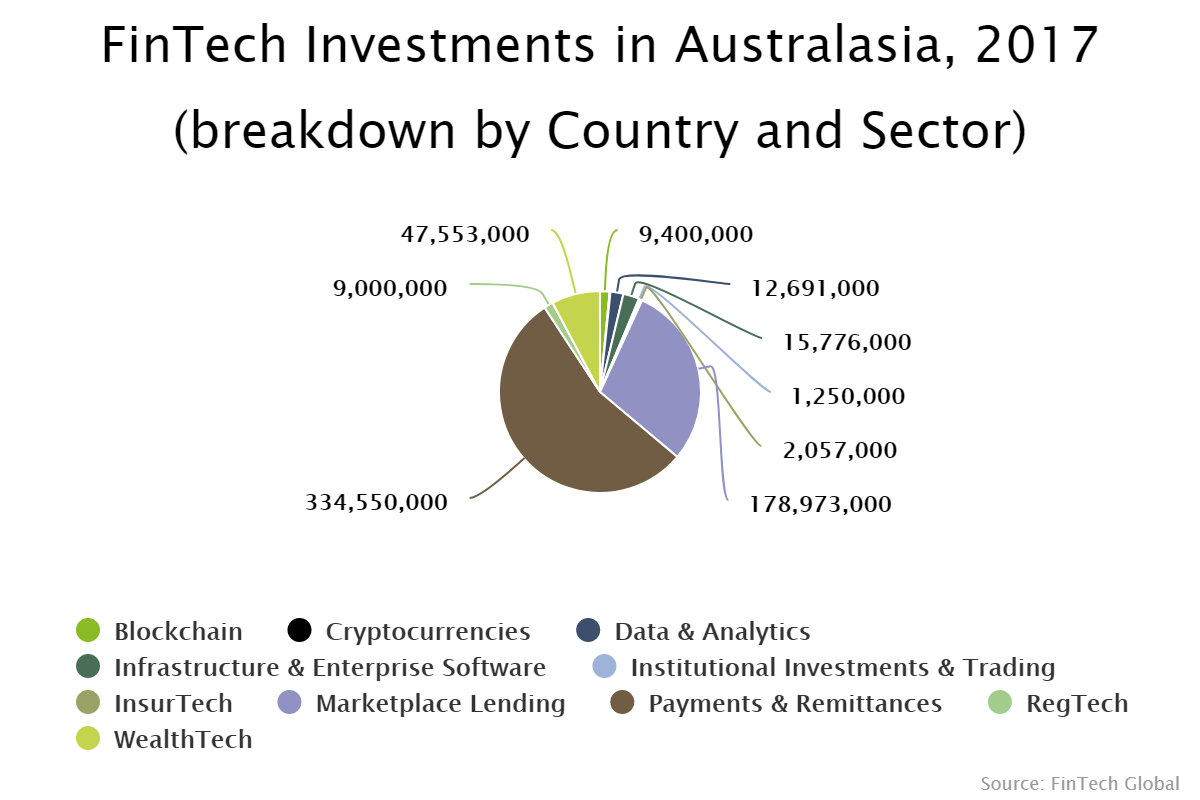

Last year, the Australian FinTech market raised a combined $612m, according to data by FinTech Global. The lion share of this funding went to the payments and remittances space, receiving 54 per cent of the capital.

WealthTech was the third biggest sector in the country during 2017, bagging $47m of the capital representing around eight per cent of funds.

Copyright © 2018 RegTech Analyst