In a new series of case studies, RegTech company Electronic IDentification explains the impact of biometrics on different industries.

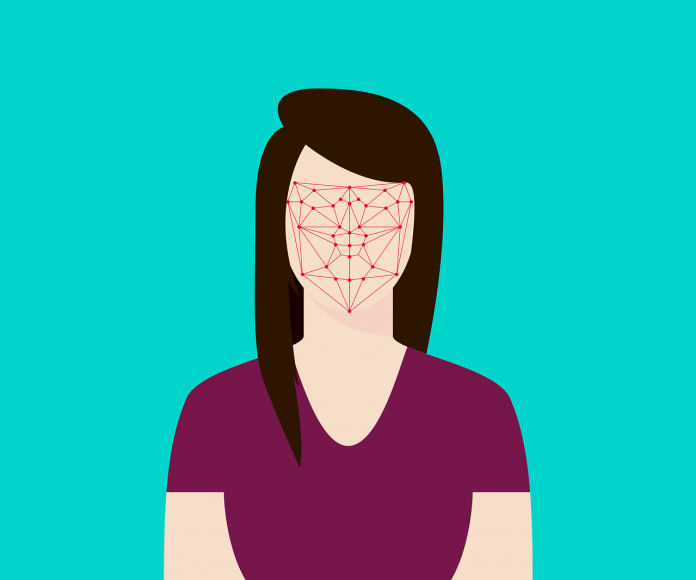

In the first part, the company explains what facial biometrics are and how the technology is regulated.

Essentially, it explains that the technology can be used to determine someone’s identity by scanning their face.

This is important as selfies and regular photos are not enough to comply with anti-money laundering regulations, the Electronic IDentification explains.

“However,” the new RegTech firm explains, “since the entry into force of the new AML5 Directive at the end of 2018 and also thanks to the eIDAS Regulation, facial biometrics have been accepted when supported by means of video identification procedures.”

Because of its added level of security, ease of use and its availability across a multitude of channels – from smartphones and tablets to laptops and desktops – it can be used in many different sectors.

The FinTech sector is no exception. Electronic IDentification explains that it can be used by financial services to accept payments, pay for things in retail stores and withdraw money from ATMs.

You can read the full article here.

Copyright © 2018 RegTech Analyst