There were 456 RegTech deals completed in the US between 2015 and 2019, with over $10bn raised across these transactions. Companies operating in the Cybersecurity/Information Security subsector captured over 25% of deal activity in the country.

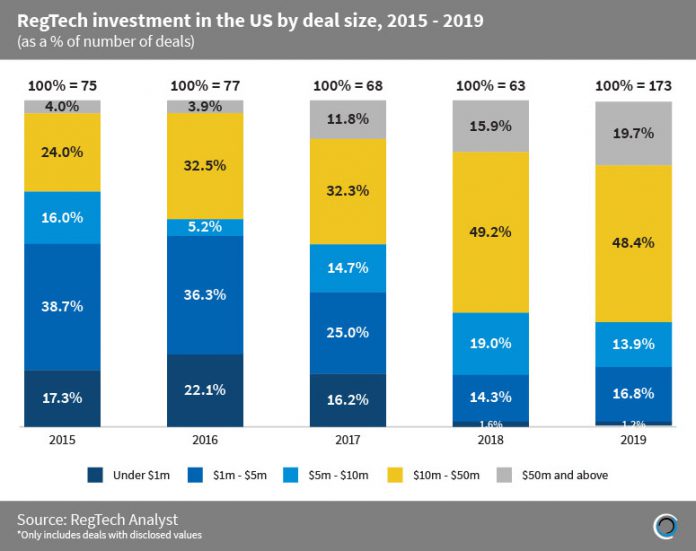

The proportion of US RegTech deals valued below $5m dropped by 38pp from 56% in 2015 to 18% in 2019, which shows that the industry continues to mature.

Rubrik, a US cloud data management company, raised $261m in a series E round led by Bain Capital Ventures in January 2019. The company used the investment to continue funding innovation and to support the launch of their new products.

Originally in 2015, only 4% of deals were valued at $50m and above, but this share has increased to 19.7% last year. According to Ascent RegTech, there has been an increase in regulatory pressure with higher regulatory fines taking place. The Securities and Exchange Commission (SEC) reported 2,754 enforcement actions in 2019, which includes 95 against US public companies the highest amount in the last 10 years. As a result, this has created more pressure on risk and compliance teams, which leads to increased compliance spending and larger rounds of funding being raised to capture the opportunity.

Copyright © 2018 RegTech Analyst