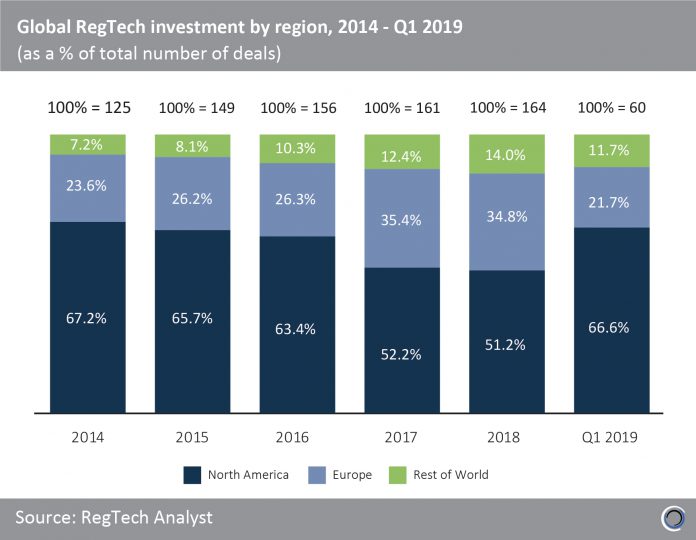

There was a continued shift in the centre of gravity of global RegTech deal activity from North America to other regions of the world between 2014 and 2018. North America has dominated with 516 transactions completed during the period; but, the region saw its share of total deals drop from 67.2% in 2014 to just over half of all deals 2018.

However, the proportion of deal activity involving RegTech companies based in North America rebounded, accounting for two thirds of transactions in Q1 2019, up from 51.2% last year. The share of deals in Europe grew from 23.6% to 34.8% between 2014 and 2018, before dropping to just over a fifth of deals in Q1 2019, with deal activity in the rest of the world (RoW) following a similar trend.

Prior to 2016, the ‘RoW’ category was defined purely by Israel, Australasia and Asia, however South America entered the race, with three transactions completed each year since 2016. Idwall, an Onboarding Verification solution provider based in Sao Paulo, raised a $3m Series A round in Q1 2018.

NsKnox, an Israeli cybersecurity firm providing payment fraud detection solutions, raised $15m in a Series A round which was the largest RegTech deal outside North America and Europe in Q1 2019. Funding was led by Viola Ventures and M12, Microsoft’s venture fund, and will enable NsKnox to expand its global customer base.

Copyright © 2018 RegTech Analyst