AML encompasses the regulations and procedures that regulated entities employ to prevent the conversion of illicit funds into seemingly legitimate income.

According to FullCircl, these measures are pivotal in tracking and reporting suspicious activities potentially linked to financial crimes. Businesses typically scrutinize customers against lists of Politically Exposed Persons (PEPs), sanctions, and adverse media to assess their risk profiles.

Concurrently, identity verification is vital in the financial services sector, where it’s crucial to confirm the identities of individuals opening accounts or engaging in transactions. This process involves collecting data like names, addresses, and government-issued IDs, and matching this information against various databases, including those from Credit Reference Agencies (CRAs) and electoral rolls, ensuring the person is who they claim to be.

The synergy between AML and identity verification forms a cornerstone of Customer Due Diligence (CDD), crucial for AML compliance. With stringent identity verification protocols, businesses not only adhere to legal standards but also shield themselves from severe penalties and reputational damage.

The significance of AML and identity verification extends beyond regulatory compliance. It serves as a defence mechanism against financial abuses that can undermine economies and fuel illicit activities like terrorism. In 2023, the failure to implement robust AML systems led to fines totalling $7.1bn for various financial institutions, highlighting the dire consequences of non-compliance.

Moreover, a robust AML and identity verification process builds customer trust by ensuring that financial transactions and account activities are constantly monitored for anomalies, thereby fostering a secure environment.

Despite their importance, these processes are fraught with challenges. Financial institutions grapple with ever-changing AML and KYC regulations across different jurisdictions, adding to the complexity of compliance. Technological limitations also pose significant barriers, especially for customers lacking digital resources, complicating their onboarding experience.

Moreover, stringent AML systems are prone to generating false positives, where legitimate customers are flagged as suspicious, causing delays and potential customer dissatisfaction. Privacy concerns also loom large as verifying identities requires accessing sensitive personal data, necessitating robust security measures to prevent breaches.

Looking forward, the domain of AML and identity verification is poised for transformation, driven by advancements in technology. Artificial intelligence and machine learning are increasingly being leveraged to enhance the precision of detecting suspicious activities and reducing false positives. Blockchain technology promises a more secure and transparent method of conducting identity verification, potentially revolutionizing the sector.

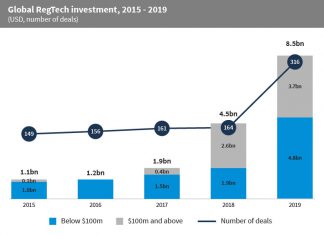

The adoption of biometric verification methods, such as facial recognition and fingerprint scanning, is also on the rise, offering a more secure and user-friendly verification process. Furthermore, the growth of Regulatory Technology (RegTech) aids financial institutions in keeping pace with regulatory changes more efficiently.

As financial crimes transcend borders, international cooperation and standardized practices will be crucial. Institutions must embrace global standards for AML and identity verification to effectively combat international financial crime.

Copyright © 2024 RegTech Analyst

Copyright © 2018 RegTech Analyst