Tag: Anti-Money Laundering

Five key benefits of moving financial crime compliance to the cloud

As financial institutions navigate an increasingly complex regulatory environment, many are finding that cloud technology offers a reliable solution for future-proofing compliance efforts. The move to cloud-based financial crime compliance not only enhances agility but also helps institutions meet stringent regulatory requirements more effectively.

How AI is shaping the future of financial crime prevention strategies

As artificial intelligence (AI) continues to advance, its role in financial crime prevention is growing, with organisations now considering AI as a foundational element in their risk management strategies.

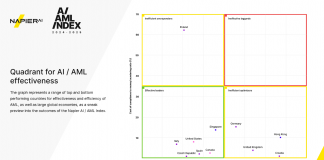

New Napier AI report highlights $3.13trn potential savings with AI in...

Napier AI, a RegTech company offering a range of compliance tools and services, has launched its inaugural AI / AML Index, revealing that artificial intelligence could enable global economies to save $3.13trn annually by enhancing the detection and prevention of money laundering and terrorist financing.

Key strategies to maximize efficiency in AML case management

In today's rapidly evolving FinTech landscape, the capacity to effectively manage a growing volume of financial transactions is paramount, particularly with the rise in digital transactions.

Flagright welcomes Zero Fintech as customer to pioneer sustainable digital banking

RegTech firm Flagright has welcomed Zero Fintech, a climate-conscious finance app, as its newest customer.

Harnessing AI and data integrity in fighting financial crime

In today's rapidly evolving digital world, the fight against financial crime networks demands both vigilance and innovation.

Why robust compliance is key to harnessing BaaS opportunities

Banking as a Service (BaaS) has been celebrated as a significant catalyst within the European FinTech industry, driving its influence on a global scale. Napier AI, which offers a financial crime compliance solution, recently explored why a risk-based compliance approach is vital for BaaS.

Seven key insights into the US’s beneficial ownership reporting requirements

In a stride towards combating financial crimes, the US introduced the CTA, designed to peel back the layers of secrecy often associated with business...

UAE’s digital leap: How regulatory sandboxes fuel AML compliance

The United Arab Emirates (UAE) is experiencing a notable economic surge, becoming a magnet for foreign investments and job opportunities. This economic growth is coupled with ambitious plans under the UAE Digital Economy Strategy launched in April 2022, aiming to increase the nation's GDP contribution from digital services from 9.7% in 2022 to 19.4% over the next decade. The strategy positions the UAE as a pivotal digital economy hub both regionally and globally.

Navigating the complex world of customer due diligence regulations

Customer Due Diligence (CDD) stands as a cornerstone in the ongoing battle against money laundering and terrorist financing. It compels regulated entities to collect and verify personal details—name, address, date of birth, and government-issued identification—from customers to authenticate their identities and assess potential financial crime risks.