New York-based investment app Stash has raised $25m in its Series B round.

Valar Ventures led the round with Breyer Capital, Goodwater Capital and Entrée Capital also participating.

The round comes just months after the company closed its $9.25m Series A in August.

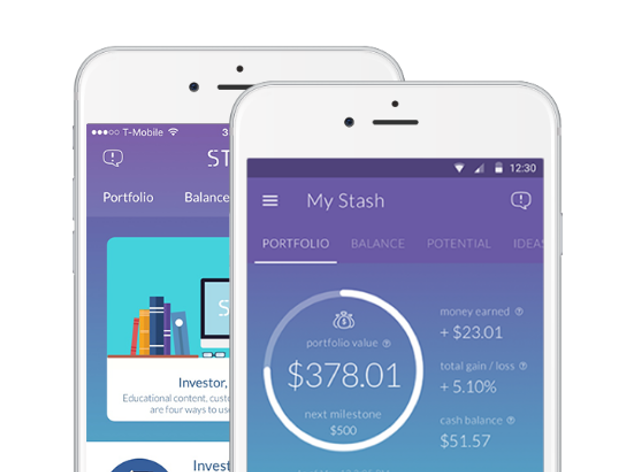

Stash aims to break down complex financial language to make investing more accessible to the 100m Americans it claims have limited access to financial opportunities.

The app allows users to pick investments from a selection of 30 ETFs (Exchange Traded Funds) chosen by Stash.

These are picked based on a model driven by factors including historical performance, expense ratio, risk profile and asset allocation.

Company CEO and co-founder Brandon King said, “Our goal is to break down the barriers to investing by promoting financial literacy, helping people develop smarter financial habits and empowering those who have been undeserved by the financial services industry.”

Stash charges a straight $1 monthly fee for accounts under $5,000 and 0.25% for accounts of more than $5,000.

Users are also not charged commissions for trades or fees for transferring money between accounts.

Stash claims it added more than 300,000 customers in just over a year and doubled its customer base in the four months since it closed its August Series A.

The company says the capital will be used to serve its expanding community and develop new features, services and products.

Copyright © 2016 FINTECH GLOBAL

Copyright © 2018 RegTech Analyst