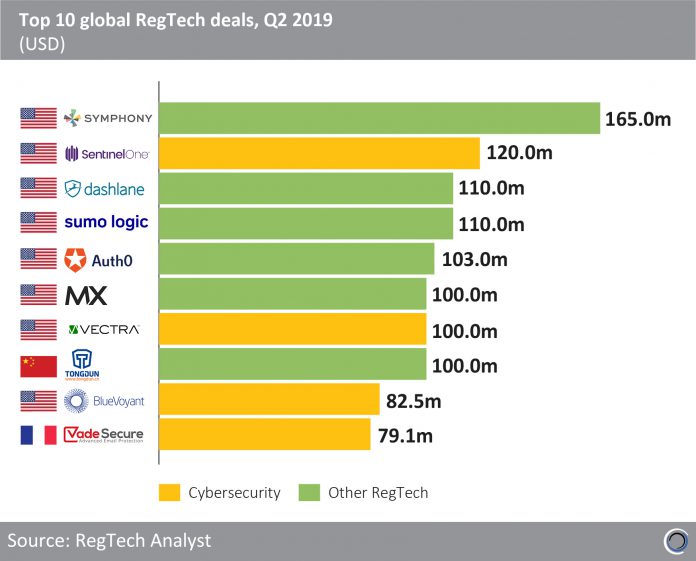

Almost $1.1bn was raised in the top 10 global RegTech deals of Q2 2019, with eight of the 10 companies in the list based in the United States. This dominance has been consistent, with US companies claiming eight of the top 10 deals last quarter, and more than 60% of the total capital raised in the subsector since 2014 has gone to US-based RegTech companies.

Although there is limited geographic diversity among companies in the list, there is some subsector diversity with four cybersecurity solutions providers (SentinelOne, Vectra AI, BlueVoyant and Vade Secure), three Identification/Background Checks companies (Dashlane, Auth0 and MX Technologies), two Risk Management solution providers (Sumo Logic and Tongdun Technology) and Communications Monitoring solution provider; Symphony.

Symphony raised a $165m Series E round led by Mitsubishi UFJ which was the largest RegTech investment of the quarter, and the company now counts some of the largest financial institutions such as Barclays, HSBC and JP Morgan as investors.

Tongdun Technology provides risk control and anti-fraud solutions for fraud management applications in financial services, leveraging AI and big data analytics. The Hangzhou-based RegTech company raised a $100m Series D round in April 2019 from China Merchants Capital, China Everbright Limited, GGV Capital, Cinda Sinorock Capital and Guotai Asset Management, and was the only company not based in the US to be listed in the top 10 deals list of Q2 2019.

Copyright © 2018 RegTech Analyst