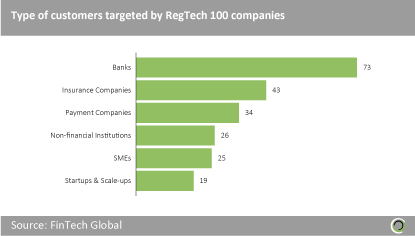

The majority of RegTech solutions are aimed at helping banks improve their compliance function

Just under three-quarters of RegTech companies are looking for banks as customers, which clearly occupy the largest segment of the RegTech market and offer the biggest scope for performance enhancements and cost reductions. Forty-three companies are providing RegTech solutions for insurance companies, while around a third offer products for payment companies.

A quarter of companies are targeting non-financial companies and a similar number are looking to sell to SMEs. Startups and scale-ups are sought after customers by 19 RegTech companies.

RegTech companies are most keen to partner with banks

More than a third of RegTech companies are looking to partner with banks, which is to be expected given that banks and financial institutions look to benefit the most from the cost savings achieved from RegTech solutions. One fifth of RegTech companies are looking to partner with other startups & scale-ups. Highlighting the desire to collaborate with other innovative companies. 16 RegTech 100 companies are interested in partnering with non-financial institutions or insurance companies and 13 companies said they would look for partnerships with payment companies or SMEs.

The most forward-thinking financial institutions are actively engaging with innovative RegTech companies

There is a clear disparity between the innovative financial institutions that are engaging directly with RegTech companies, compared to the mainstream institutions.

The same names appear more often than not. Banks such as Barclays, Santander, BBVA and BNP Paribas have taken industry-leading positions in terms of committing their organizations to a radical digital re-engineering and have been actively engaging with FinTech and RegTech companies.

There appears to be no correlation between the size of bank or financial institution and the level of RegTech engagement. Indeed, the absence of a number of very large institutions is surprising. The organizations that have committed to a digital future appear to have done so whole-heartedly and are backing several RegTech companies at a time. Larger institutions that have yet to engage in the general FinTech space appear to be taking a major risk, whilst those that have committed to FinTech, but are not yet active in RegTech, may be missing out on what might prove to be the subsector within the FinTech universe that creates the most profound and far-reaching changes to the financial services industry.

Copyright © 2018 RegTech Analyst

Copyright © 2018 RegTech Analyst